- International markets face turmoil, with cryptocurrencies and main inventory indices experiencing extreme declines.

- Arthur Hayes predicted that Japan’s yen fluctuations may enhance cryptocurrencies.

On the fifth of August, a significant upheaval rocked the worldwide financial system, with markets together with Japan going through a extreme downturn.

Cryptocurrencies bore the brunt of this shift, as Bitcoin [BTC] and different altcoins plunged by double digits amid widespread threat aversion.

This dramatic decline within the crypto sector mirrored the broader monetary instability.

Japan’s Nikkei index skilled its most important drop in a long time and European shares falling sharply, marking their worst efficiency in two years.

In the meantime, the Bombay Inventory Alternate in India closed with a drop of over 2,000 factors.

Expressing issues on the identical, the top of technique at Astris Advisory in Tokyo Neil Newman to CNN famous,

“That was a crash. It smelled like 1987. At this time was relentless. It was uncommon as a result of there was the absence of a rebound on the finish of the day, which you’d usually see as a result of brief overlaying.”

Including to the fray was, Andrew Lokenauth, who mentioned,

What’s behind the worldwide bear market?

There are speculations that the turbulence within the U.S. monetary markets might be influencing Japan’s financial situations.

For these unfamiliar, the Federal Reserve’s upcoming determination on potential rate of interest cuts in September has intensified market volatility, contributing to a widespread sell-off.

Shedding mild on the identical, Japanese Central Financial institution Governor Kazuo Ueda mentioned,

“If the financial system and costs transfer in keeping with our projection, we’ll proceed to lift rates of interest.”

A declining Yen may benefit Bitcoin

For sure, Arthur Hayes, co-founder of BitMEX had a novel perspective to share when he mentioned that the yen’s fluctuations may affect tech inventory costs and U.S. debt dynamics.

He additionally signifies that if U.S. policymakers reply to Japan’s charge modifications as he anticipates, it may have a optimistic impact on cryptocurrency markets.

Effectively, this isn’t the primary time Hayes has connected Japan’s financial actions with cryptocurrency worth developments. Beforehand, in his weblog titled ‘Easy Button,’ he famous,

“I feel {that a} USDJPY surge in the direction of 200 is sufficient to placed on the Chemical Brothers and “Push the Button.”

“Chemical Brothers” refers back to the U.S. and Japan, whereas “Push the Button” means printing cash or ‘injection of liquidity.’

Right here, Hayes predicted {that a} weakening yen may set off forex conflicts between Japan and China, doubtlessly main the U.S. to intervene by devaluing the greenback.

This might enhance dollar-based belongings and probably spark a crypto increase.

What’s the current knowledge telling us?

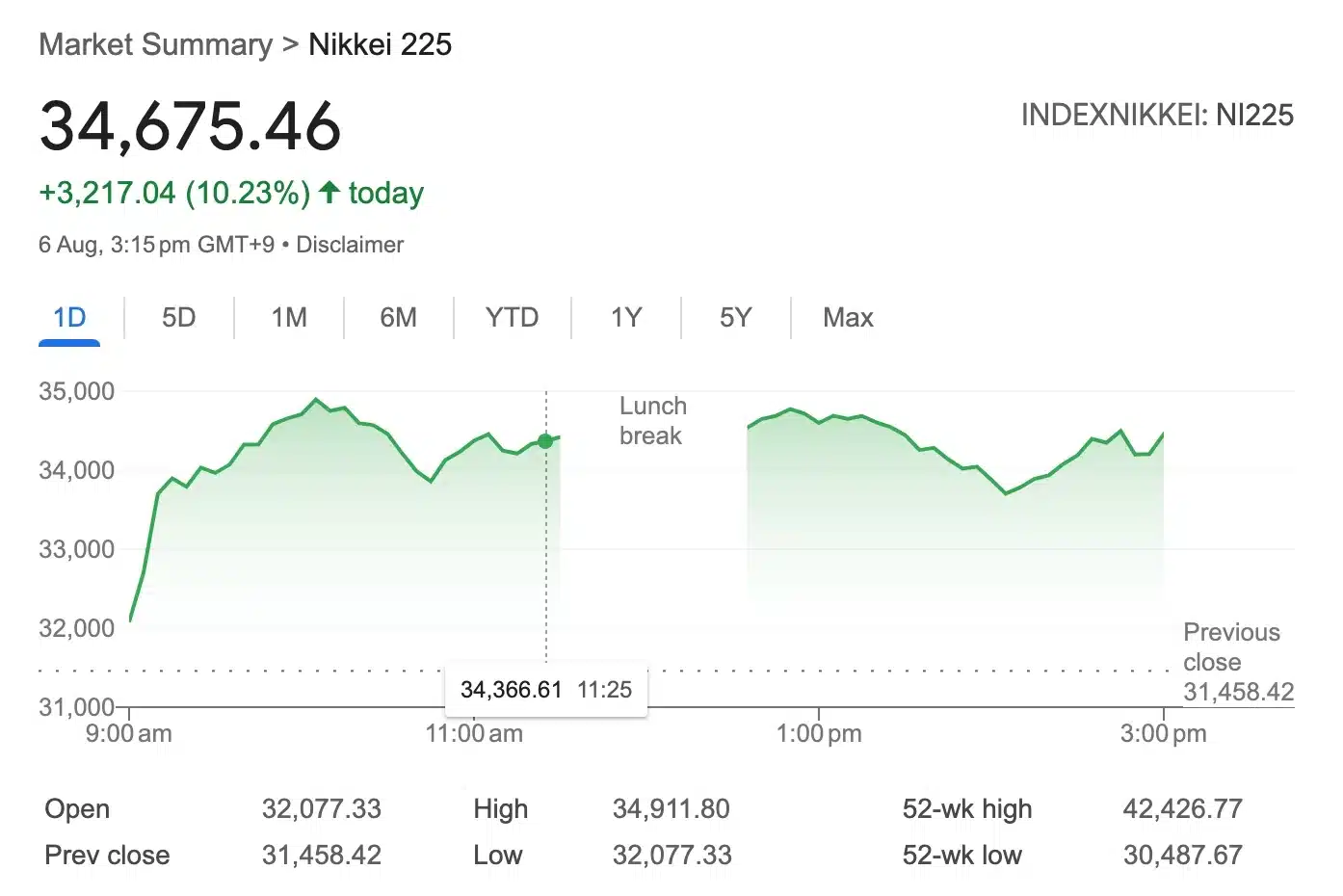

As of now, the Nikkei 225 has rebounded impressively, surging over 10% only a day after experiencing its largest two-day drop on file.

In distinction, the worldwide cryptocurrency market has additionally seen a notable uptick, with its market cap rising to $1.95 trillion—a 4.86% improve in simply 24 hours as per CoinMarketCap.

These sharp fluctuations underscore the present volatility within the financial panorama, as markets react to impending Federal Reserve choices on rates of interest.