- Bullish sentiment builds with rising lengthy positions in BTC, ETH, SOL, and ADA, fueling volatility.

- The market dangers a cascade of liquidations if key ranges like $85K for BTC or $2K for ETH are breached.

Over the previous week, bullish sentiment has intensified throughout the crypto market, with prime property like Bitcoin [BTC], Ethereum [ETH], Solana [SOL], and Cardano [ADA] witnessing a notable surge in lengthy positions.

This rising accumulation highlights rising dealer confidence but in addition heightens market dangers. As leverage builds, the market turns into extra inclined to volatility.

Even minor value actions might set off important liquidations and speedy directional shifts within the coming week.

Longs vs. shorts: Rising bullish sentiment

Up to now seven days, top cryptos have seen a clear shift towards bullish positioning. Knowledge reveals that lengthy positions are outpacing shorts throughout Bitcoin, Ethereum, Solana, and Cardano, signaling renewed dealer optimism.

This development displays rising confidence out there’s upward momentum, particularly as BTC holds above key psychological ranges and Ethereum continues to profit from much-anticipated ecosystem developments.

In contrast to earlier consolidation phases, the place shorts sometimes dominated throughout uncertainty, this wave of lengthy accumulation displays optimism about sustained features. Nevertheless, rising leverage throughout the market additionally will increase dangers.

Any surprising downturn might result in speedy liquidations and cascading results in markets closely biased towards lengthy positions.

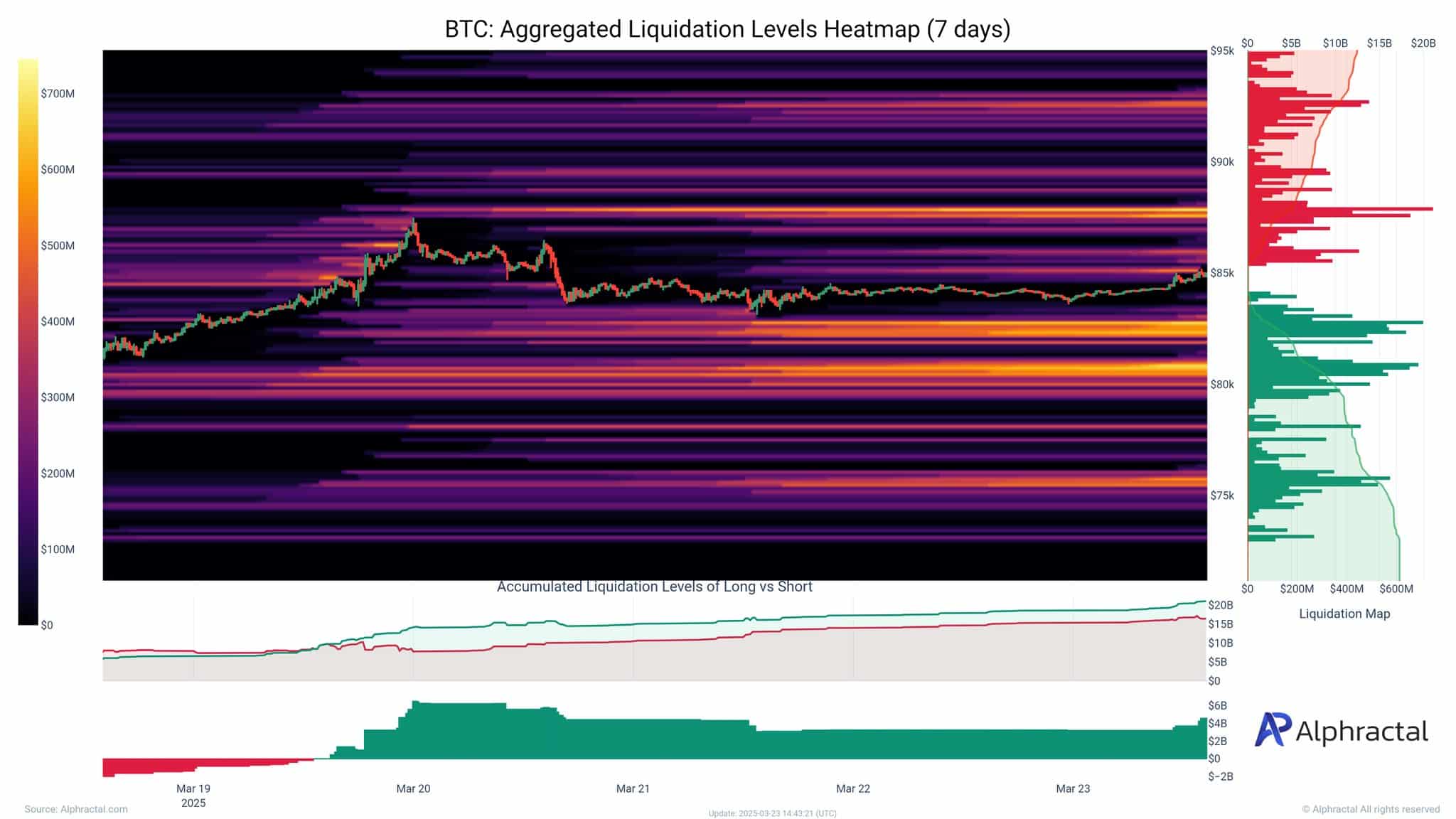

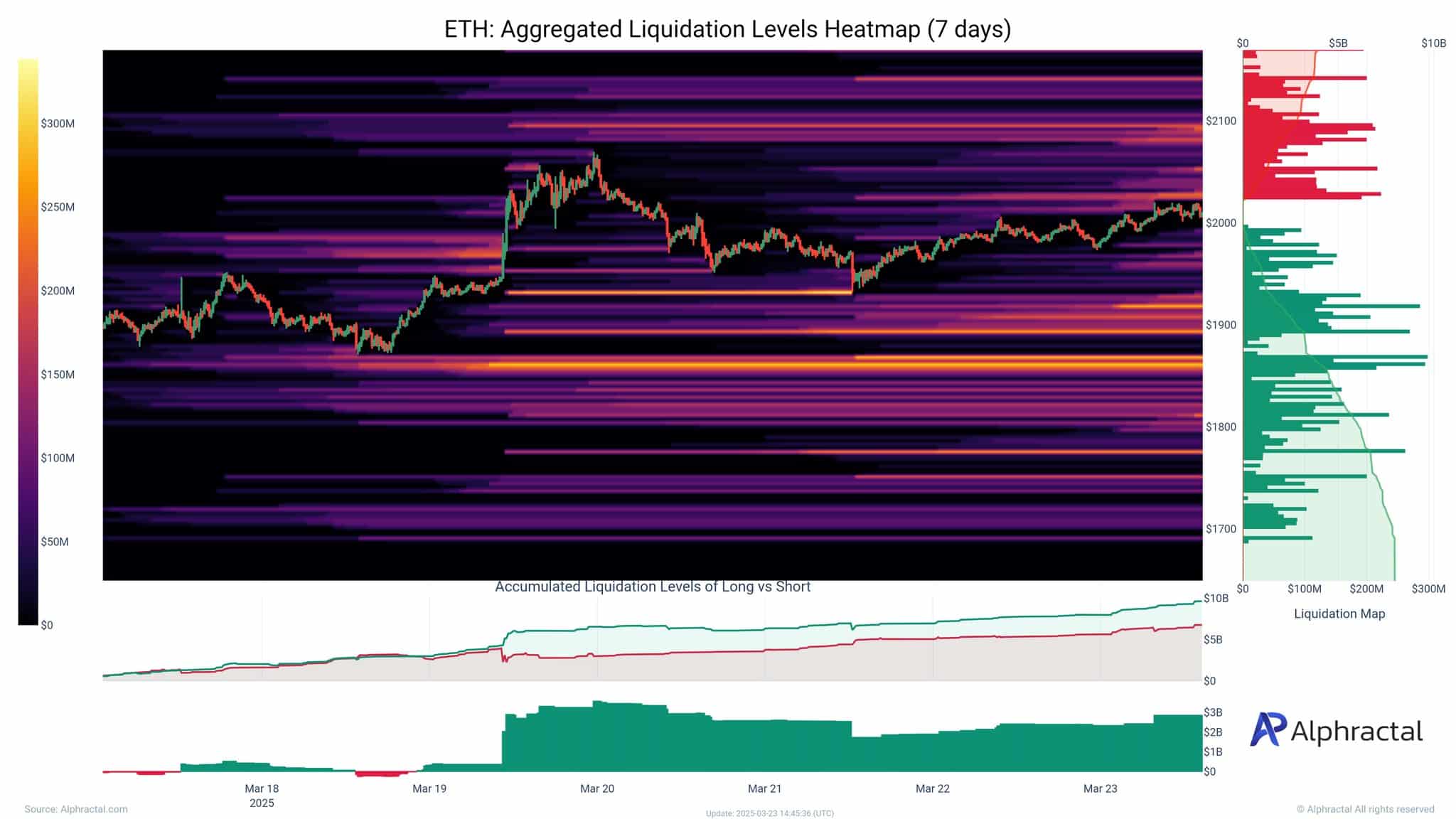

Liquidation danger mounts as longs crowd Bitcoin and Ethereum

Over the previous week, Bitcoin and Ethereum have seen a pointy buildup in leveraged lengthy positions, with liquidation heatmaps revealing densely packed danger zones.

For BTC, lengthy liquidations are stacked above $85K, with practically $20B in accrued liquidation ranges – signaling a possible cascade if costs reverse even barely.

Ethereum reveals related patterns, with concentrated lengthy positions above $2,000 and over $10 billion in liquidation danger. Merchants present confidence in continued value progress, however such heavy positioning creates market fragility.

A sudden drop beneath $80K for BTC or $1,900 for ETH might set off compelled liquidations, intensifying draw back volatility.

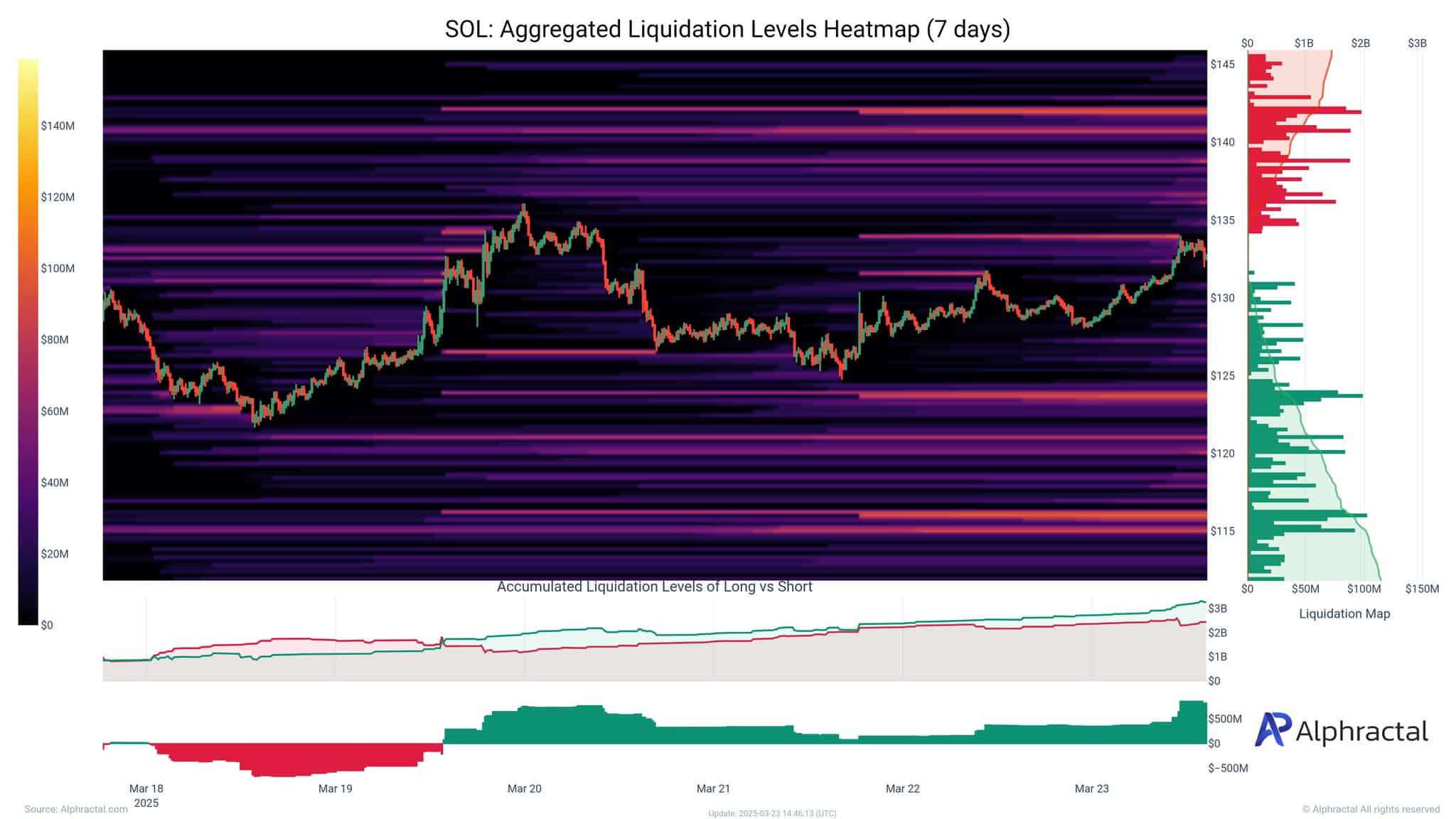

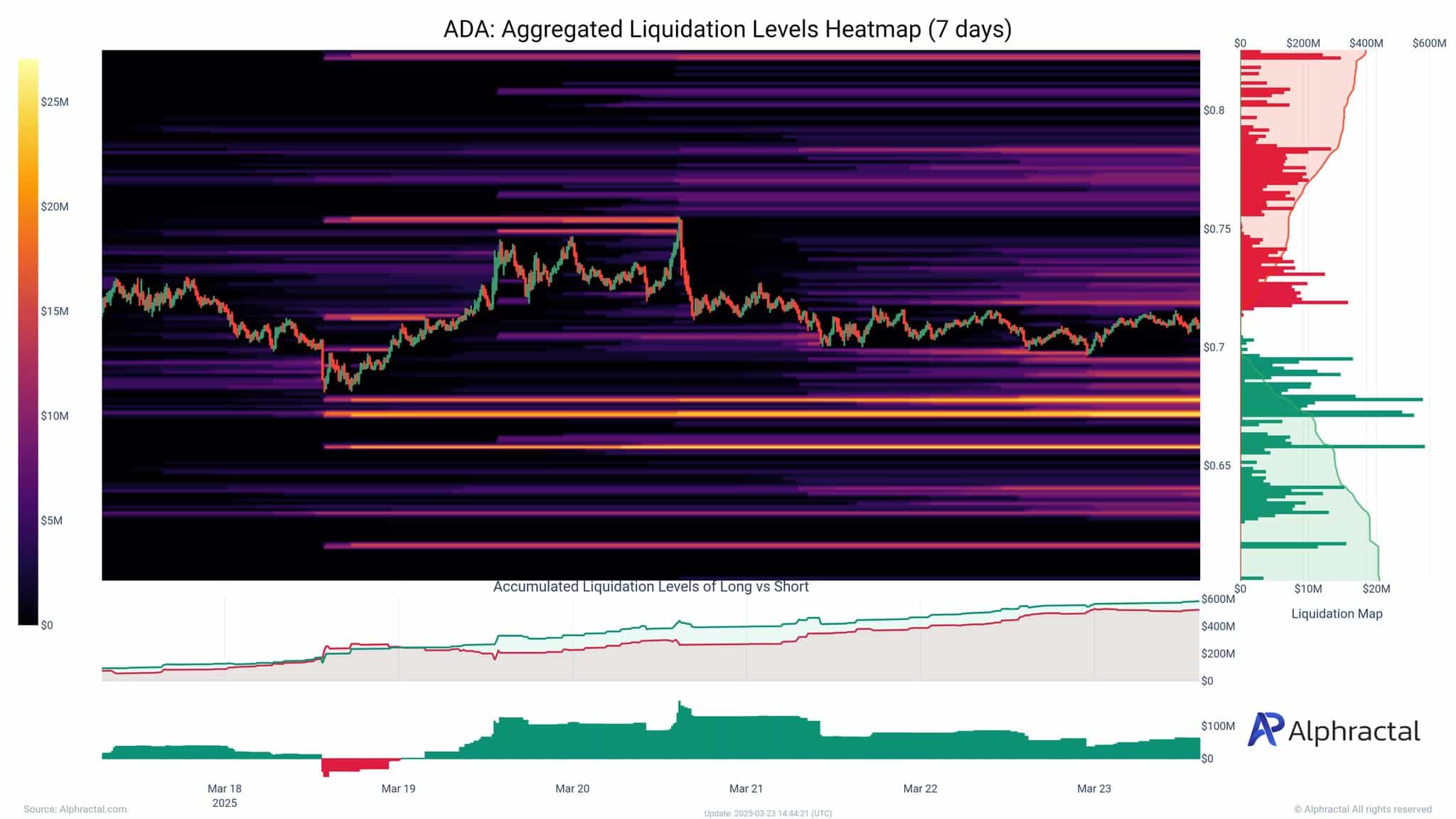

Solana and Cardano: Excessive-stakes zones

Solana reveals a notable focus of lengthy liquidations clustered between $140 and $145, with accrued lengthy positions exceeding $3B. This means a rising danger of sharp draw back volatility if value momentum stalls.

The heatmap highlights decrease assist zones round $125 and $115, the place important liquidity sits – probably appearing as magnetic ranges if sentiment turns bearish.

For Cardano, the heatmap reveals lengthy liquidations densely packed round $0.75, aligning with a current surge. With over $600M in accrued positions, any retracement towards the $0.65–$0.68 area might set off cascading liquidations.

These zones signify each danger and alternative, as merchants anticipate reactive value habits round them.