- Binance’s Richard Teng means that Bitcoin may thrive as a hedge towards financial instability.

- Regardless of short-term volatility, long-term optimism stays robust for Bitcoin amid financial uncertainty.

As international markets reel from renewed commerce tensions underneath Donald Trump’s tariff proposals, the crypto sector finds itself at a unstable crossroads.

Binance CEO outlines his religion in Bitcoin

Amid this uncertainty, Binance CEO Richard Teng has weighed in, suggesting that whereas the speedy influence may set off short-term market swings, Bitcoin [BTC] may finally profit from the broader financial instability.

In keeping with Teng, buyers might more and more view digital belongings as a hedge towards macroeconomic disruptions—doubtlessly driving demand and strengthening the case for decentralized finance in the long term.

Remarking on the identical, Teng noted,

“The resurgence of commerce protectionism is introducing important volatility throughout international markets — and crypto isn’t any exception.”

He added,

“Within the quick time period, this type of macro uncertainty tends to set off a risk-off response, with buyers pulling again as they wait to see how issues unfold round progress, coverage, and commerce.”

Bitcoin’s value motion post-tariff shock

Trump’s tariff shock has dealt a big blow to Bitcoin, which as soon as traded above $100K however is now beneath $80,000.

As of the final CoinMarketCap update, Bitcoin was buying and selling at $77,879.02, marking a 1.97% decline previously 24 hours.

Nonetheless, regardless of these short-term fluctuations, Teng stays optimistic, as he stated,

“Wanting additional forward, although, this surroundings may additionally speed up curiosity in crypto as a non-sovereign retailer of worth.”

He added,

“Many long-term holders proceed to view Bitcoin and different digital belongings as resilient in periods of financial stress and shifting coverage dynamics.”

What are the metrics hinting at?

Moreover, regardless of Bitcoin’s present value dip and bearish alerts from indicators like RSI and MACD, a more in-depth take a look at the information reveals optimism.

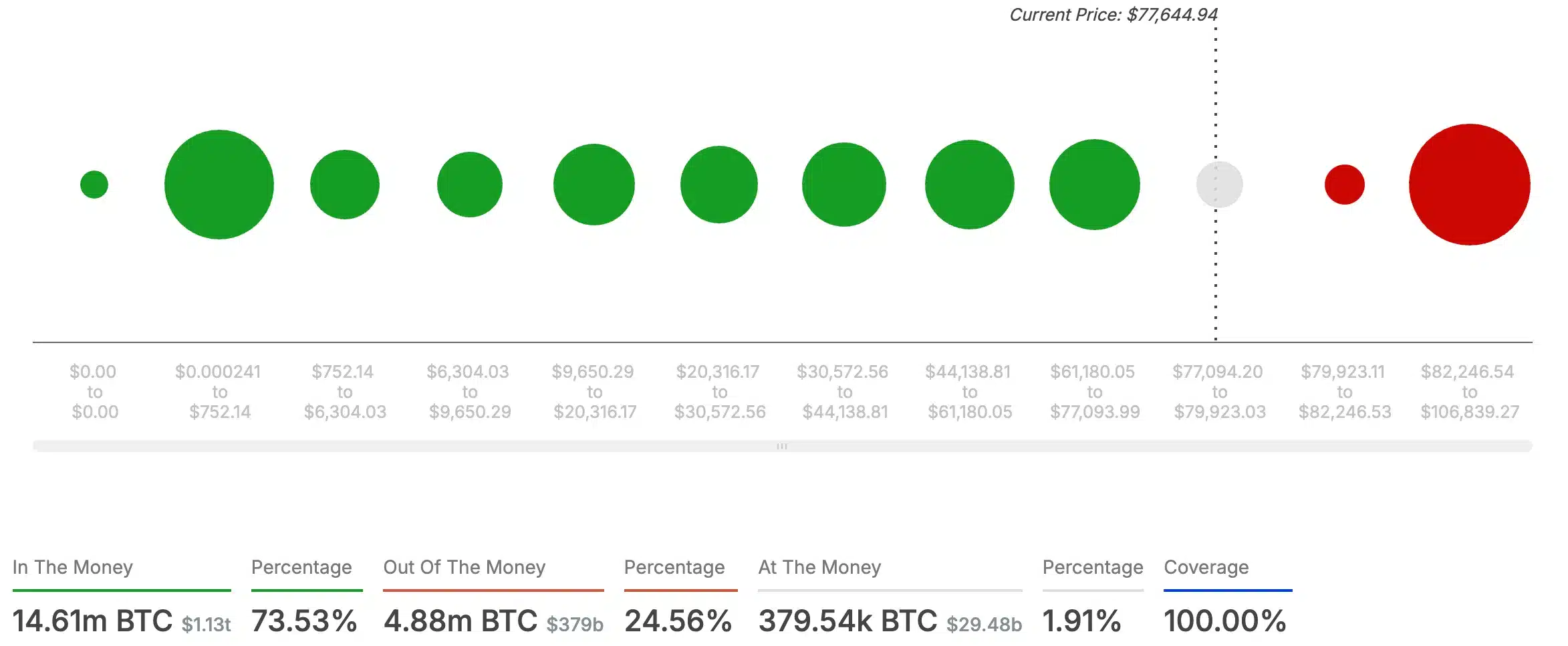

AMBCrypto’s evaluation of IntoTheBlock metrics reveals that 73.53% of Bitcoin holders are “within the cash,” which means their tokens are price greater than their buy value.

Solely 24.56% are “out of the cash,” suggesting underlying bullish sentiment and the potential for a value rally.

This adopted latest rumors of a possible 90-day tariff pause, which briefly fueled hopes of a market rebound, just for the information to be debunked as false.

Nonetheless, the market responded with spectacular good points.

Bitcoin mirrored this rally, spiking 6.5% and briefly surpassing $80,000 earlier than retracting to its present ranges.

Due to this fact, if a false rumor can set off a big Bitcoin surge, it clearly signifies the king forex’s robust resilience and market potential.