- VanEck analysts consider BTC may gain advantage extra from a ‘hostile’ Harris administration.

- Polymarket confirmed Harris maintained a 3-point lead on Trump.

In line with VanEck analysts, no matter who wins the 2024 US elections, Bitcoin [BTC] will sail by unscathed.

Nevertheless, analyst Mathew Sigel stated that BTC may gain advantage extra from a Kamala Harris administration than beneath Trump.

“I do suppose it’s doable that an unfriendly Democrat White Home may inadvertently assist BTC.”

VanEck analysts additional divulged the above outlook within the newest September BTC review.

“We might argue {that a} Kamala Harris presidency may be even higher for Bitcoin than a second time period for Trump as a result of it will, in our view, speed up lots of the structural points that drive Bitcoin adoption within the first place.”

Biden-Harris admin vs BTC

Trump has been a robust proponent of BTC, and his potential win will likely be deemed a bullish cue for regulatory easing for the sector.

Nevertheless, the analysts highlighted that the hostile Harris administration may reinforce BTC’s market dominance.

“Ought to that occur, Bitcoin’s distinctive regulatory readability will doubtless make it much more aggressive than different digital property.”

The structural issues raised had been linked to rising US money owed and financial deficits. The analysts famous that these points will persist no matter whether or not Trump or Harris wins the election.

Analysts Mathew Sigel and Nathan Frankovitz highlighted that this might weaken the US greenback, a ripe setting that has traditionally boosted BTC.

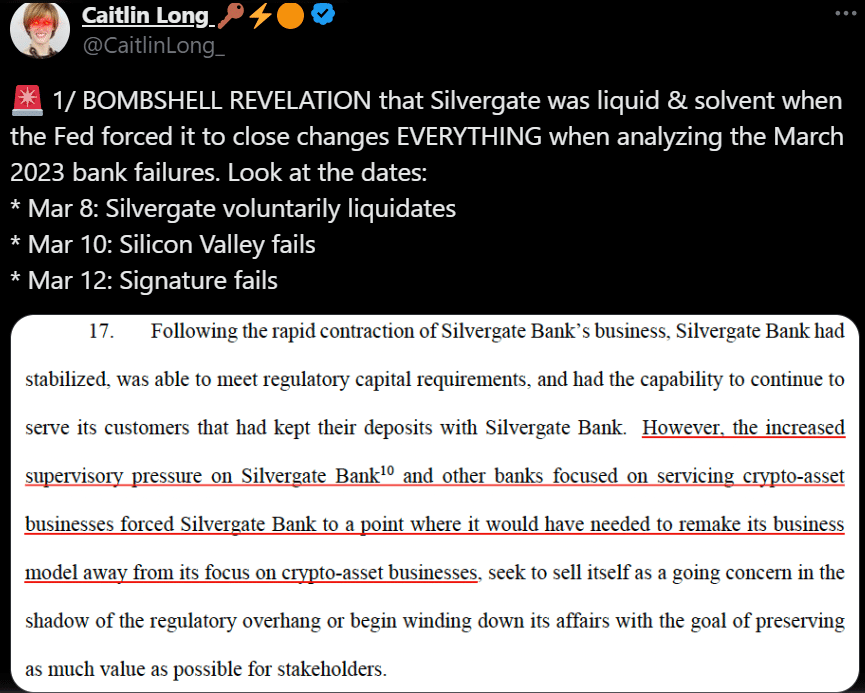

Nonetheless, market pundits have cautioned that the notorious Operation ChokePoint 2.0 (OCP) will doubtless be prolonged, with a Harris administration changing into extra doubtless. OCP refers to perceived US businesses’ restriction of crypto companies from accessing the US banking system.

That stated, a latest update indicated that Silvergate, a crypto-focused financial institution, was solvent and in a position to meet its monetary obligations however was allegedly pressured to close down beneath the Fed’s stress.

In August, the Fed put one other crypto-friendly financial institution, Prospects Financial institution, on discover. Tyler Winklevoss, co-founder of Gemini, said the continued restriction would kill the crypto business within the US.

Amid the huge de-banking amongst US crypto companies, VanEck analysts consider BTC’s regulatory readability would increase it. At press time, Harris (51%) had a 3-point lead in opposition to Trump (48%) on odds of successful US elections on the prediction web site Polymarket.

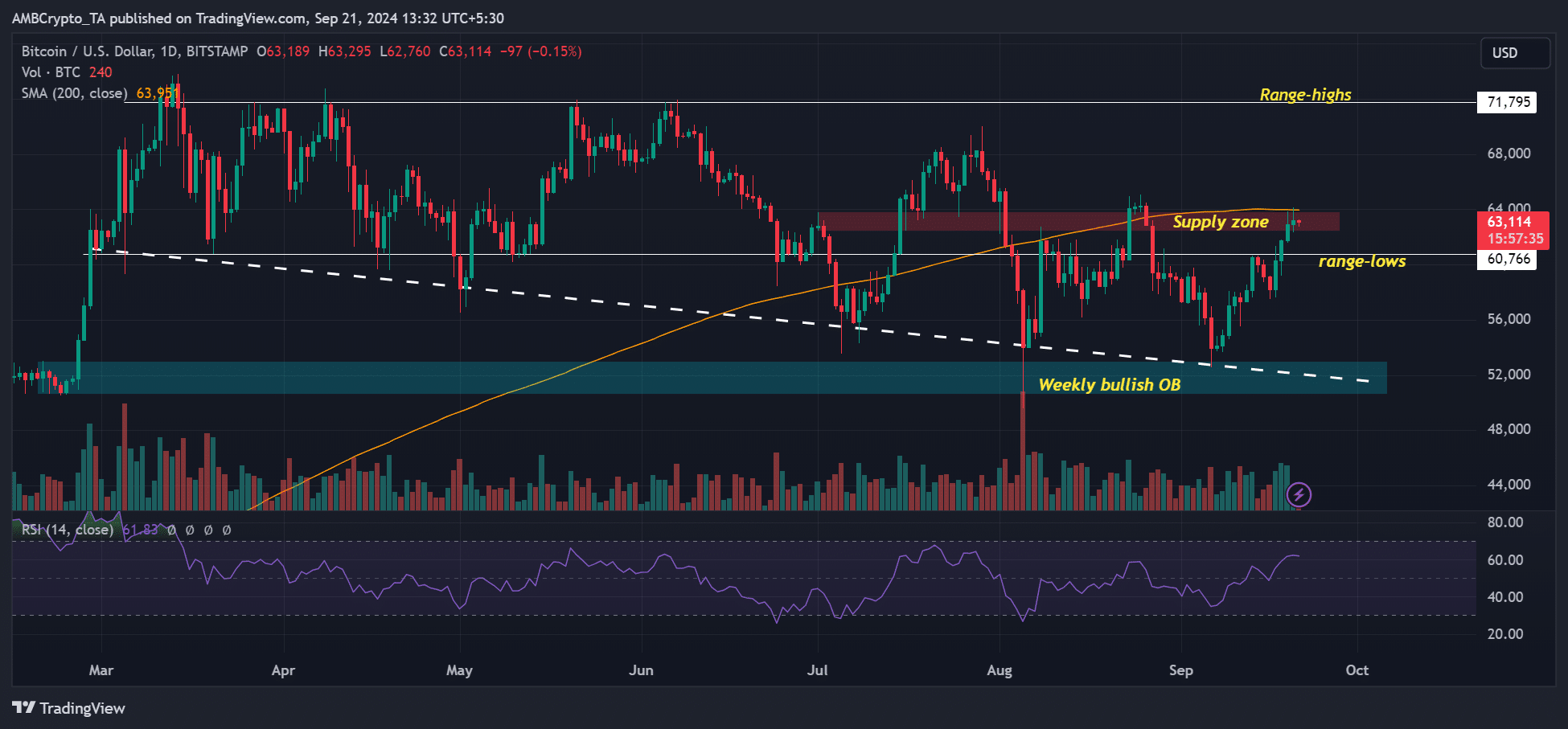

Within the meantime, BTC was valued at $63.1K at press time and was on the verge of reclaiming the 200-day Transferring Common (MA).

In line with Coinbase analysts, the asset may appeal to extra merchants’ curiosity and traction if it surged above the 200-day MA to bolster a long-term bullish pattern.