- Variety of addresses holding over 1 BTC has fallen because the begin of the yr

- Metrics revealed that traders may need been promoting to earn income

After a cushty uptrend, Bitcoin [BTC] noticed a worth drop on the charts and began to consolidate underneath $70,000. In the meantime, it could appear that big-pocketed gamers lowered their holdings in 2024 too.

Does this imply they’ve been shedding confidence in BTC? Or had been they lowering their positions to earn income?

Are whales promoting Bitcoin?

Right here, it’s price noting that whereas BTC’s worth dropped, its worth was nonetheless hovering shut its all-time excessive at press time. With Bitcoin performing as it’s, IntoTheBlock shared a tweet revealing an attention-grabbing improvement. In line with the identical, 1,013,120 addresses held greater than 1 BTC. This quantity fell from 1,024,437 because the begin of the yr.

At first look, this may recommend that whales could also be shedding confidence within the king coin. Nonetheless, the truth could be completely different. The whales may need chosen to promote their belongings in an effort to earn income. Particularly as BTC’s worth was significantly excessive on the charts.

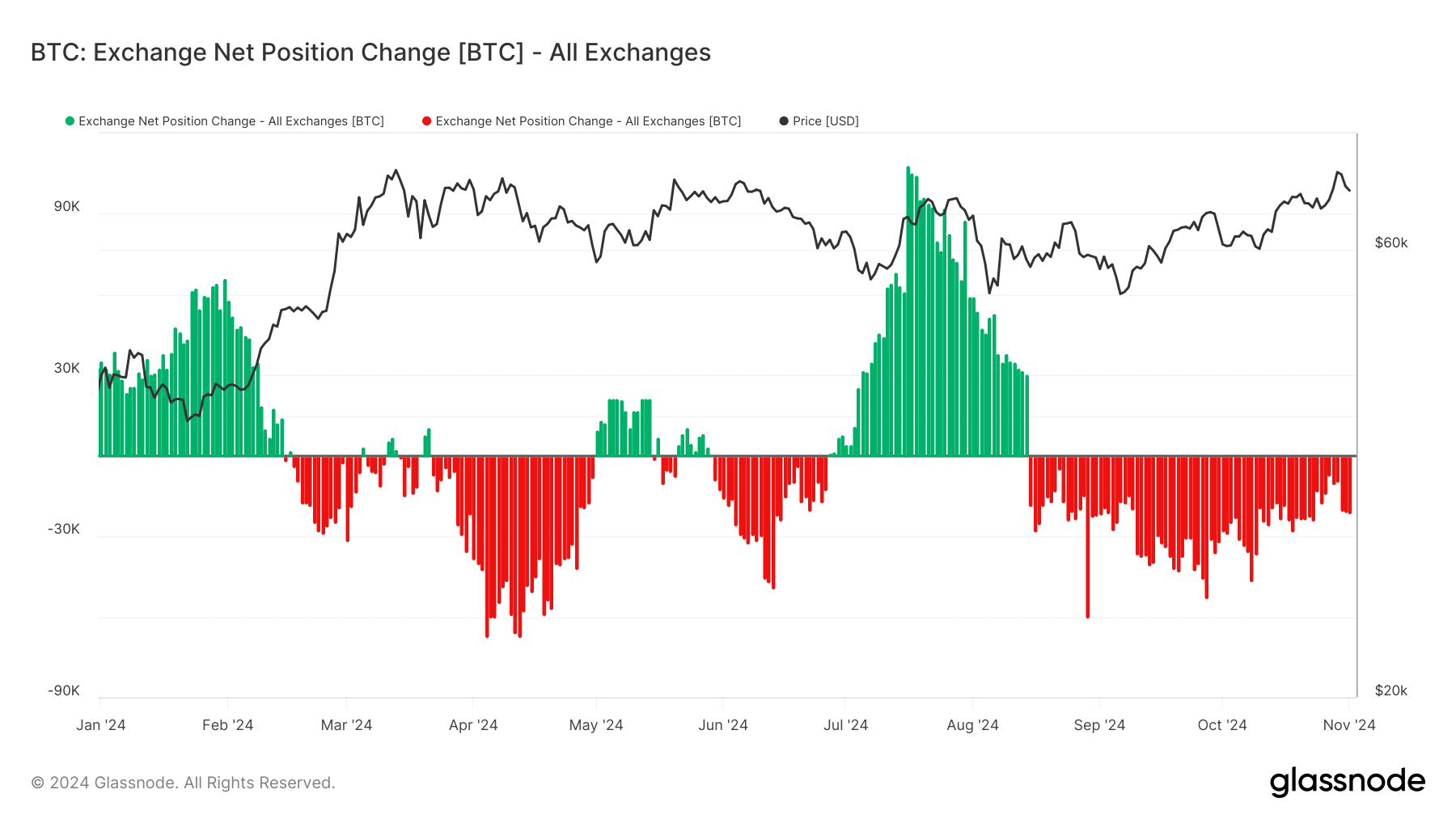

To examine the identical, AMBCrypto assessed the crypto’s on-chain knowledge. As per AMBCrypto’s evaluation of Glassnode’s knowledge, Bitcoin’s web place change remained within the destructive zone over the previous few months. A serious purpose behind this could possibly be BTC’s worth rise throughout the identical interval. Usually, when costs method ATHs, traders usually select to promote their holdings in an effort to take income.

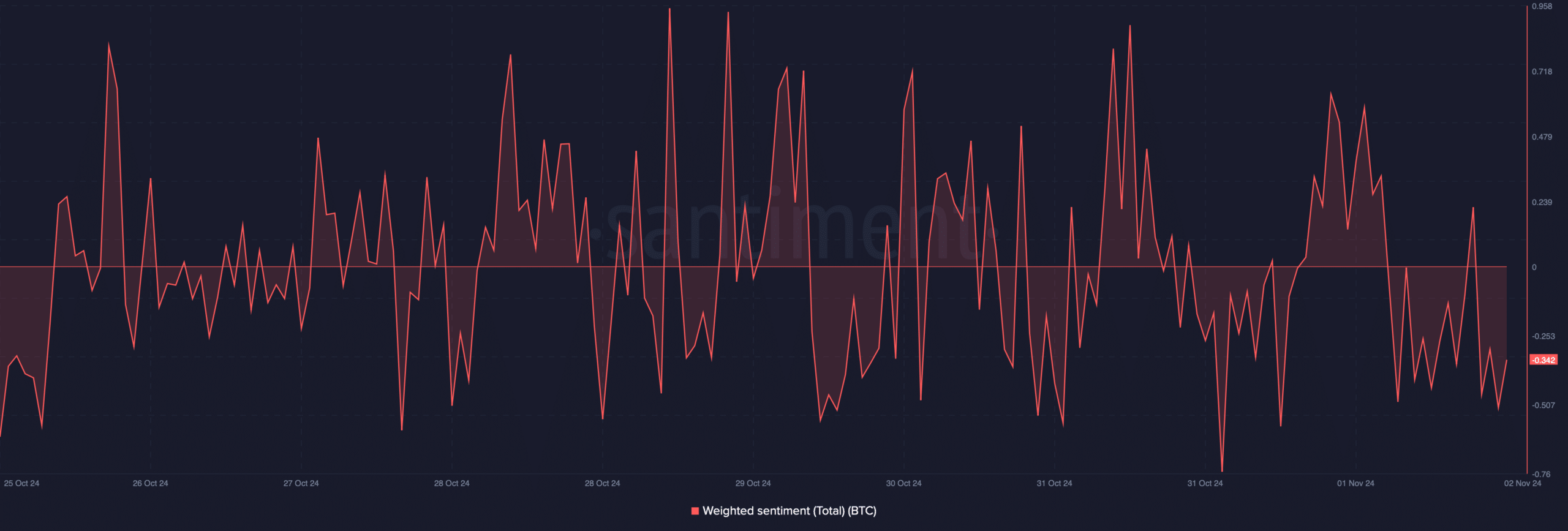

AMBCrypto then checked Bitcoin’s social metrics to seek out out whether or not confidence within the coin has really been dwindling. In line with our evaluation, BTC’s weighted sentiment saved transferring within the constructive and destructive zones continuously over the previous week.

This meant that there was not a selected sentiment that was dominant out there. Due to this fact, the opportunity of whales promoting to earn income appeared excessive.

Mapping BTC’s future

For the reason that big-pocketed plates had been taking income and lowering their holdings, AMBCrypto then assessed how this may have an effect on the crypto’s worth.

As per our evaluation of CryptoQuant’s knowledge, Bitcoin’s aSORP was purple. This indicated that extra traders have been promoting at a revenue. In the course of a bull market, it will probably trace at a market high.

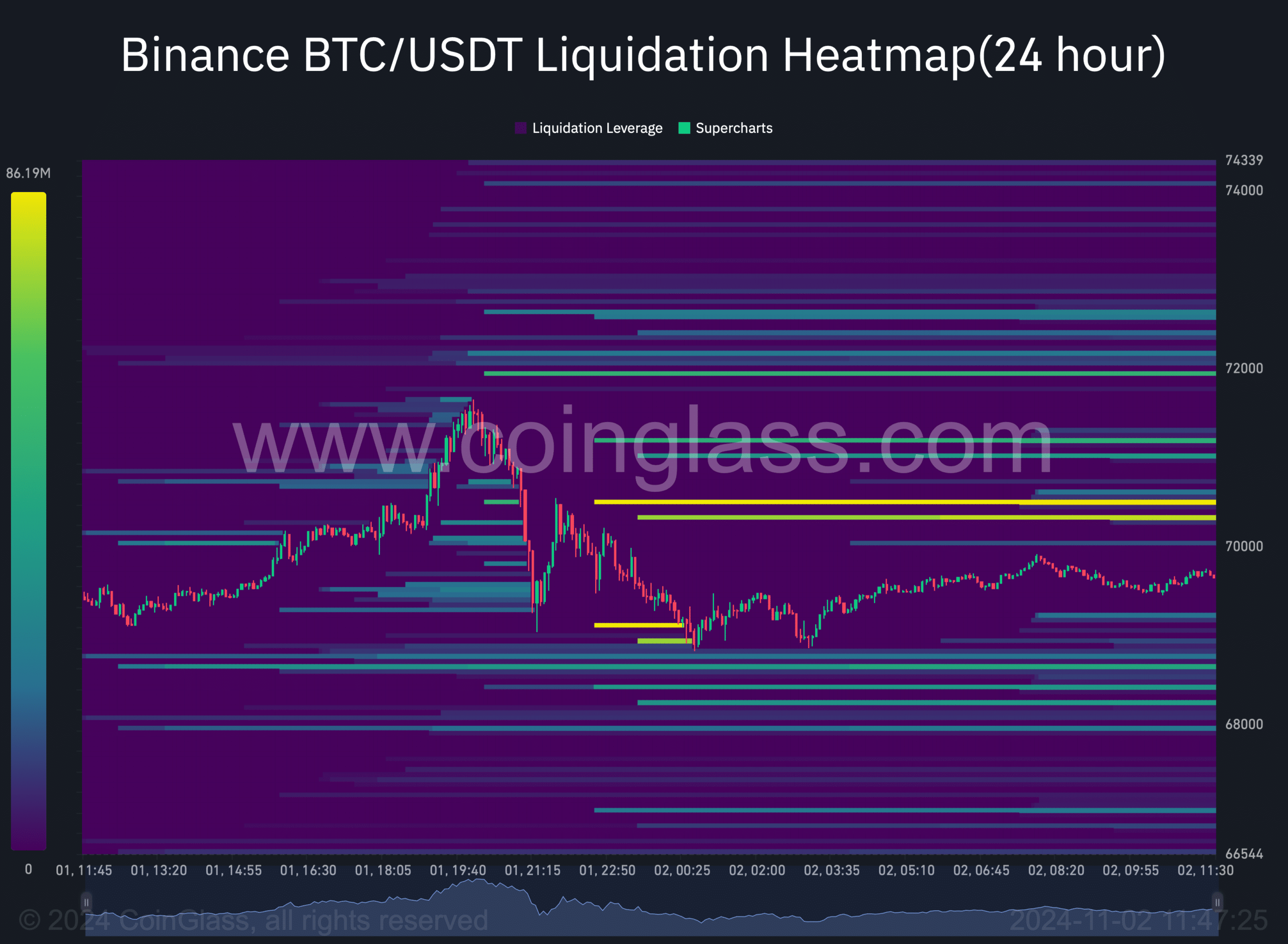

Coinglass’s liquidation heatmap additionally revealed that in case of a worth drop, BTC’s worth may decline to $68.6k. This was the case as liquidations will rise sharply, which may probably act as a help from the place bulls would have a chance to bounce again.

Learn Bitcoin’s [BTC] Price Prediction 2024-25

Nonetheless, AMBCrypto reported that BTC’s NVT ratio dropped over the previous couple of days – A discovering that hinted at a worth hike.