- BTC might need topped on this cycle, per Peter Brandt.

- Nonetheless, different market analysts disagreed.

Bitcoin [BTC] noticed some reduction bounce on the twenty first of August after July’s FOMC Minutes indicated that some policymakers advocated for charge cuts.

The biggest digital asset briefly retested $61K, however the general sentiment has remained weak.

In reality, August is BTC’s fifth month of value consolidation, elevating doubts about whether or not the asset will hit a brand new ATH (all-time excessive).

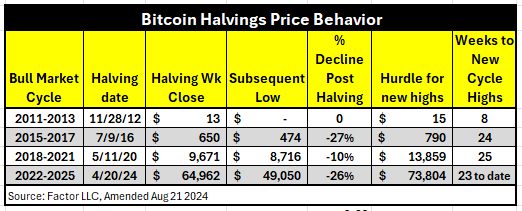

Based on Peter Brandt, the present cycle was taking too lengthy to hit a brand new ATH, which could signal {that a} BTC cycle high was already in.

“Present bull market cycle in $BTC will quickly grow to be the longest time publish halving in historical past for a brand new ATH or, might point out that new ATH isn’t within the playing cards.”

BTC is on observe; Different analysts disagree

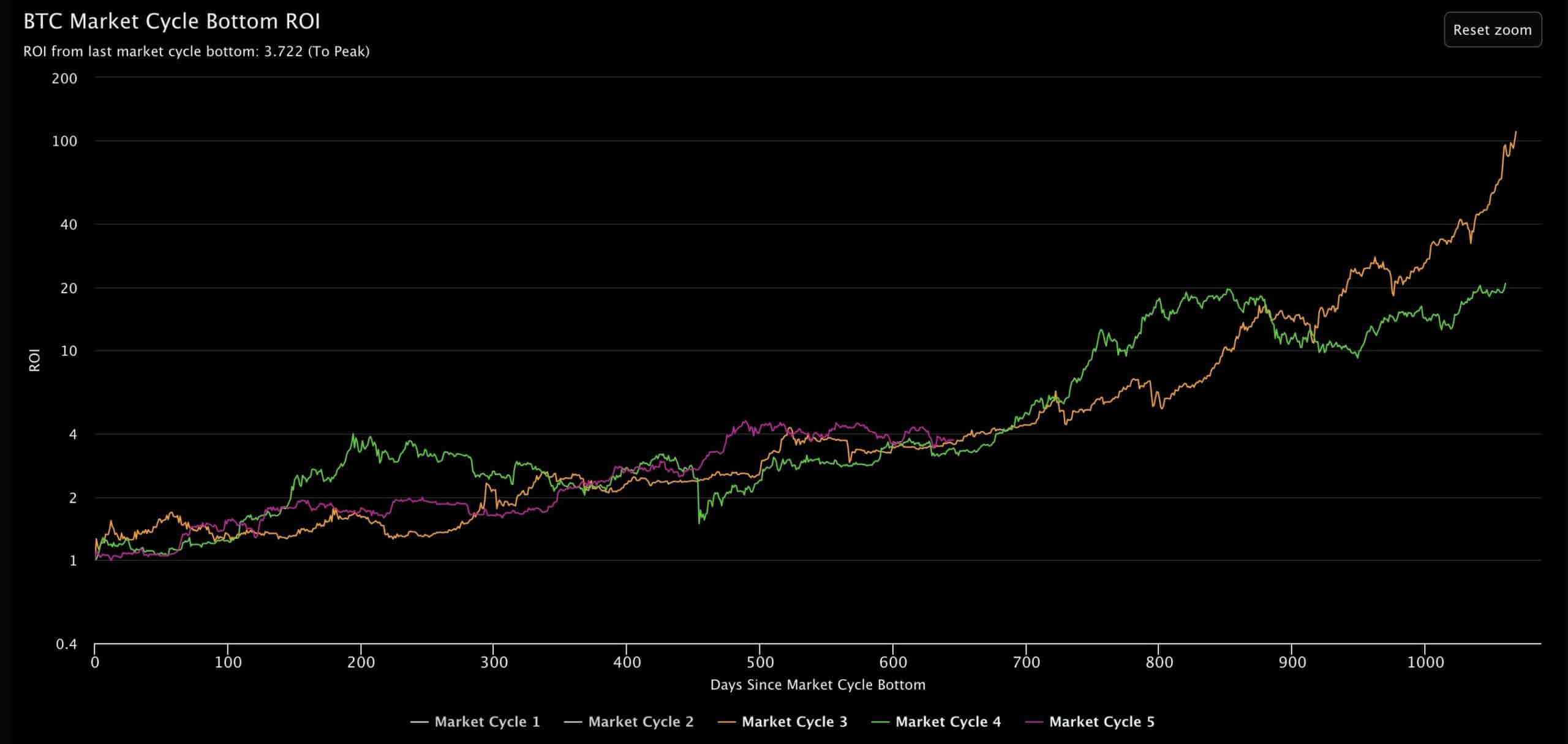

Nonetheless, different crypto analysts have disagreed with Brandt’s bearish outlook. Based on Benjamin Cowen, BTC was on track and in sync with different historic market cycle actions.

“Regardless of all the things, #BTC is true round the place it all the time is at this level out there cycle.”

Based mostly on the hooked up chart, BTC was getting ready to the following leg of a rally if the historic development continued.

The subsequent section of the BTC rally might start in This autumn, in accordance with CryptoQuant founder Ki Younger Ju, who cited doubtless whale actions.

“Within the final #Bitcoin halving cycle, the bull rally started in This autumn. Whales received’t let This autumn be boring with a flat YoY efficiency.”

One other knowledge level that prompt a possible BTC upswing was the current drop in Funding Charges alongside an uptick in Open Rates of interest. Based on K33 Analysis, this market set-up was ‘ripe’ for a brief squeeze.

“Market circumstances are wanting ripe for a brief squeeze. BTC perps notional open curiosity has jumped by 30k BTC since August 13, with constant detrimental funding charges.”

Moreover, Glassnode revealed that BTC’s Lengthy-Time period Holders (LTH) have lowered profit-taking, which traditionally tends to usher in a brand new value uptrend.

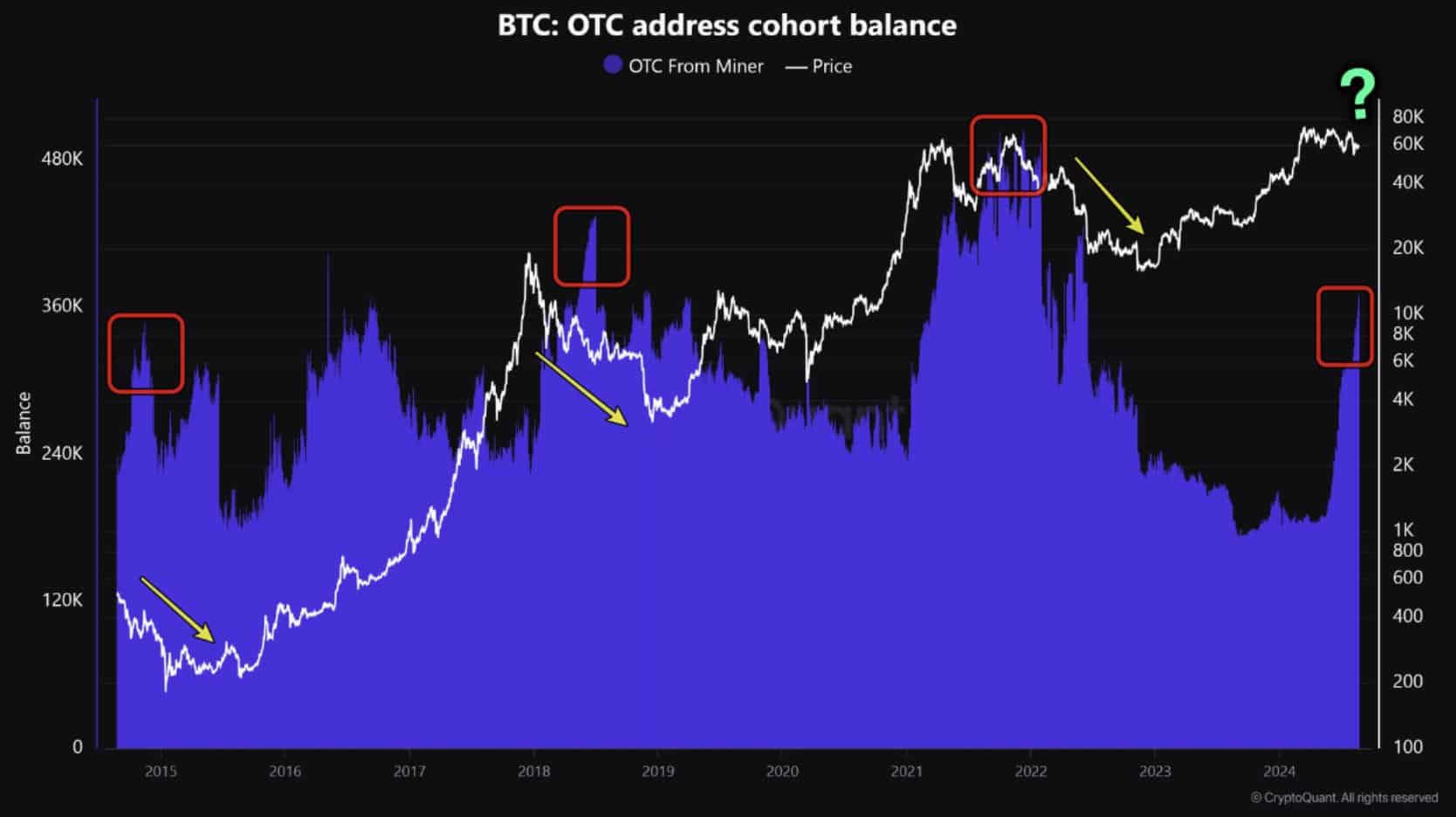

Nonetheless, in accordance with CryptoQuant, BTC stock on OTC (over-the-counter) markets increased to a file two-year excessive, which might suppress BTC restoration within the brief time period.

“Bitcoin OTC Desk Balances Soar to Two-Yr Peak. Traditionally, will increase in #Bitcoin OTC desk balances have been related to declines in Bitcoin costs.”

In conclusion, BTC had extra upside potential if the historic development seen in post-halving repeats. Nonetheless, the anticipated rally might face dangers from the rising BTC steadiness on OTC markets.