- Trump’s tariff announcement wiped $490M from crypto as Bitcoin and Ethereum costs plunged sharply.

- Worry overtook sentiment whereas correlated inventory sell-offs deepened crypto’s downward momentum.

The cryptocurrency market noticed intense volatility prior to now 24 hours, sparked by U.S. President Donald Trump’s sweeping new tariffs.

These included a minimal 10% obligation on all imports, with increased charges for key companions like China (34%), Japan (24%), and the European Union (20%).

Because the information broke, each conventional and digital markets reacted shortly. Bitcoin [BTC] dropped from $88,500 to $83,500, whereas Ethereum [ETH] fell from $1,934 to below $1,800 on the time of writing.

Furthermore, the overall crypto market cap slipped by 2%, settling close to $2.68 trillion. This drop occurred throughout the mid-Japanese buying and selling session on the third of April.

Such a pointy response underlines how delicate crypto stays to international macroeconomic shocks. Due to this fact, these tariffs didn’t simply disrupt international commerce—they precipitated a direct hit to digital belongings.

Liquidations wipe out over 160,000 merchants

Following the latest value plunge, over $490 million in leveraged positions have been liquidated, affecting greater than 160,000 merchants. The most important single liquidation occurred on Binance, the place an ETH/USDT place price $12 million was closed. Most losses have been incurred by lengthy merchants who had guess on rising costs.

Bitcoin futures accounted for $170 million in liquidations, whereas Ethereum contracts misplaced $120 million. Smaller altcoins contributed a further $50 million to the overall.

Curiously, volatility impacted each market instructions—$257 million got here from liquidated lengthy positions, whereas $232 million got here from shorts. This downturn in the end punished each bullish and bearish merchants.

Market sentiment shifts sharply into worry

At first, the market skilled a quick wave of optimism. Nonetheless, as merchants absolutely assessed the influence of the tariffs, that confidence shortly dissipated.

Markets analyst Rachael Lucas reported a 46% surge in buying and selling quantity, pushed by giant gamers adjusting their positions. Retail merchants, however, remained largely cautious.

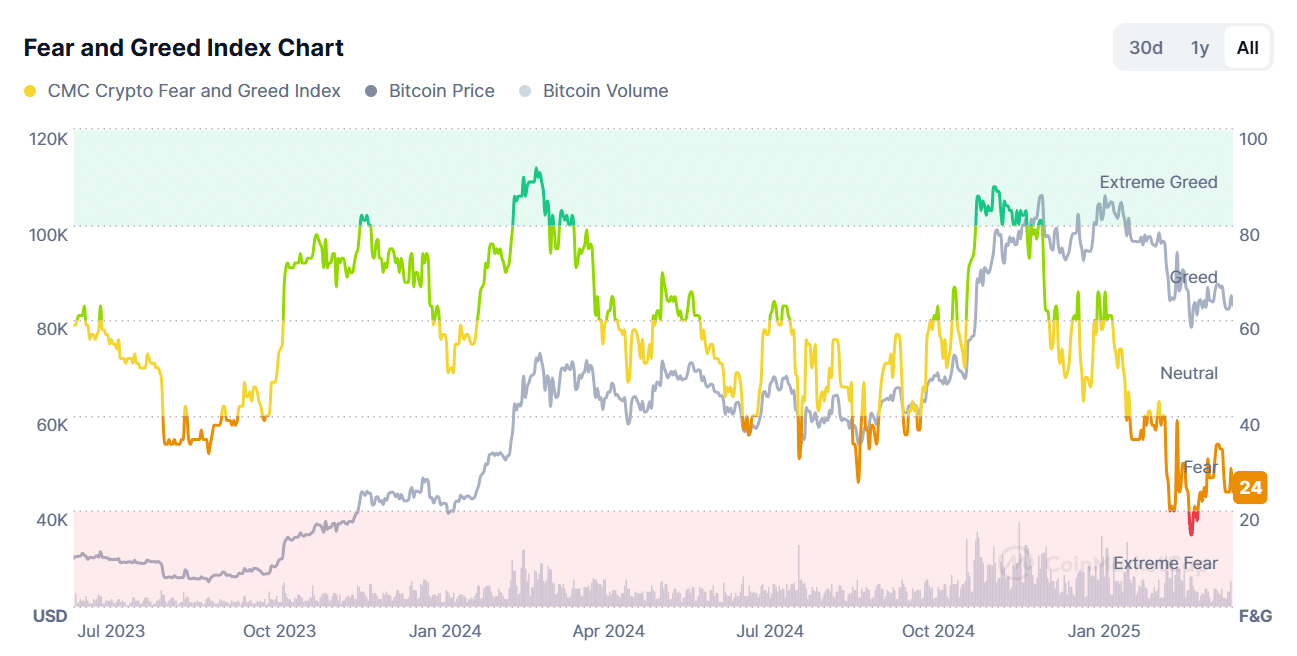

The Crypto Worry & Greed Index dropped to 24, indicating heightened worry throughout the market. Only a week in the past, sentiment was nearer to impartial. This sharp shift in investor outlook highlights how delicate the market is to vital coverage modifications.

Heavy inventory market sell-off fuels crypto losses

The S&P 500 futures shed $2 trillion in market capitalization inside simply quarter-hour of the announcement. Main tech shares, together with Apple (-5.59%), Amazon (-4.50%), and Nvidia (-3.43%), skilled vital losses.

This broad sell-off additionally spilled over into cryptocurrency markets.

As crypto markets have grown extra correlated with equities, each sectors declined in unison. Consequently, the panic in conventional finance magnified the crypto crash. The shock was each quick and carefully tied to widespread financial fears.

Conclusively, the crypto market crash in the present day was precipitated straight by U.S. commerce tariff bulletins.

These sparked worry, triggered mass liquidations, and aligned with a worldwide fairness sell-off. Due to this fact, clear geopolitical coverage—not rumors—was the basis reason behind the crash.