- Exploring the potential Bitcoin value affect by just lately rising political tensions.

- A take a look at similarities between now and 2022 and assessing variations which will result in a special end result.

Bitcoin’s [BTC] value motion has had a wide range of influences over time. From financial influences to geopolitical publicity, however may the escalating geopolitical outcomes within the Center-East affect Bitcoin?

Earlier than we discover the potential Bitcoin affect, it’s value stating one thing. Battle, particularly of the bodily nature, is in opposition to human progress, and we sympathize with these affected.

The specter of main geopolitical conflicts has widespread affect, particularly on the markets.

Traders are typically extra reluctant to take a position not simply in Bitcoin, but additionally the broader risk-on funding panorama throughout occasions of battle.

This was the case in February 2022 when the Russia-Ukraine battle commenced. Bitcoin and the remainder of crypto skilled important outflows because the funding panorama switched to a cautious stance.

Will Bitcoin find yourself in the same scenario this time?

Bitcoin has already skilled important outflows up to now within the final 5 days, falling from $66,000 to its $60,450 press time.

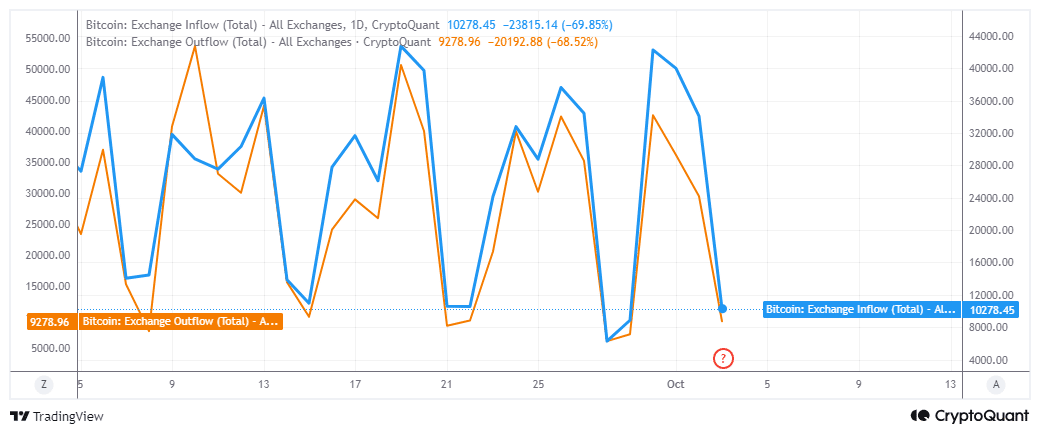

Trade inflows have been at 10,278 BTC within the final 24 hours whereas change outflows have been decrease at 9,278 BTC.

Greater change inflows than outflows signaled that Bitcoin might dip beneath $60,000 in direction of the weekend if the promote stress stays.

Nonetheless, it’s value noting that each inflows and outflows have been slowing down for the final three days.

It was unclear whether or not the risky geopolitical scenario had a hand available in the market sentiment up to now. It is because the promote stress this week might also be the results of profit-taking from Bitcoin’s rally in September.

Whereas it’s attainable that the rising tensions might affect Bitcoin by influencing sentiment, the present scenario additionally occurs to be a bit totally different.

BTC’s promote stress in early 2022 had a number of components hammering down on the cryptocurrency.

This was across the similar time that governments have been elevating rates of interest, therefore liquidity was flowing out of the market a lot sooner.

Learn Bitcoin’s [BTC] Price Prediction 2024–2025

One of many greatest variations this time is that world liquidity is on the verge of rising courtesy of price cuts. In different phrases, the dynamics are far a lot totally different this time.

Finally, geopolitical tensions should still have an effect within the short-run, however that affect could also be diluted by the altering liquidity scenario.