- Bitcoin has registered a powerful uptrend these days, with analysts eyeing a parabolic rally to $276,400

- Final 24 hours noticed BTC hike by 2.08% on the charts

After weeks of sideways motion and even consolidation on the value charts, the legislation few days lastly noticed Bitcoin [BTC] unfold its wings. In reality, the cryptocurrency’s bullish rally pushed the cryptocurrency to as excessive as $105k for the primary time in 2025.

On the time of writing, nevertheless, BTC had retraced considerably, with the cryptocurrency down to only over $103k.

Even so, its value declaring that its newest worth pump allowed Bitcoin to interrupt out of a cup and deal with sample – Highlighting potential for sturdy upside. For sure, with one other breakout presumably rising, analysts are actually left eyeing extra positive aspects.

In reality, crypto analysts like Ali Martinez are hypothesising {that a} rally to $276,400 could also be so as in 2025.

Merely put, though the market has seen pessimism after a chronic consolidation, this sudden upswing is an indication that rallies can emerge even when some contributors flip bearish.

How bear zones construct sturdy Bitcoin rallies

In accordance with CryptoQuant, sturdy Bitcoin rallies can emerge from bear zones if market contributors are affected person sufficient. This was seen over the previous week too, at a time when BTC dropped under $90k on the charts.

As per this evaluation, once we have a look at Bitcoin’s pullbacks, an enchanting sample emerges. When the market dips into the bear zones, and buyers lose hope, the market sees a rebound.

Thus, endurance is a powerful alternative for buyers. Traditionally, after quiet durations, Bitcoin tends to register a powerful upswing on the charts. Due to this fact, after each main pullback, the market pauses, takes a breath, after which enters a stronger uptrend.

Whereas pink zones may initially discourage buyers, historic patterns revealed that the rebounds from these ranges are sometimes much more spectacular.

What do BTC’s charts say?

Whereas the evaluation supplied above gives us a promising outlook, it’s important to find out what different market indicators counsel too.

In accordance with AMBCrypto’s evaluation, Bitcoin is at present in a bullish part with bulls having market management.

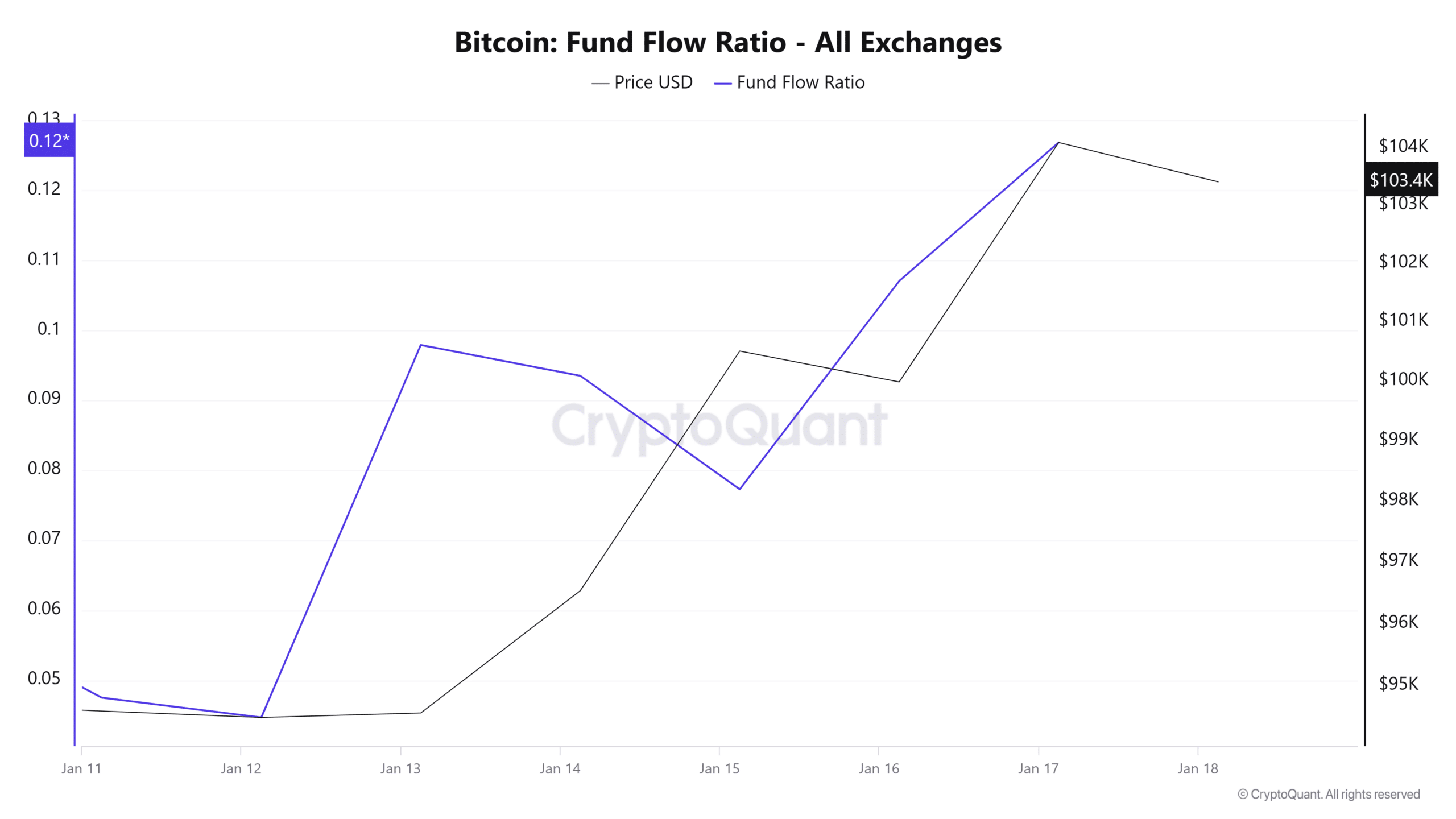

For instance, Bitcoin’s fund circulate ratio spiked over the previous week to 0.12.

When this rises, it indicators a surge in capital inflows into BTC as buyers purchase extra tokens. This may be seen as an indication of better shopping for stress and accumulation developments.

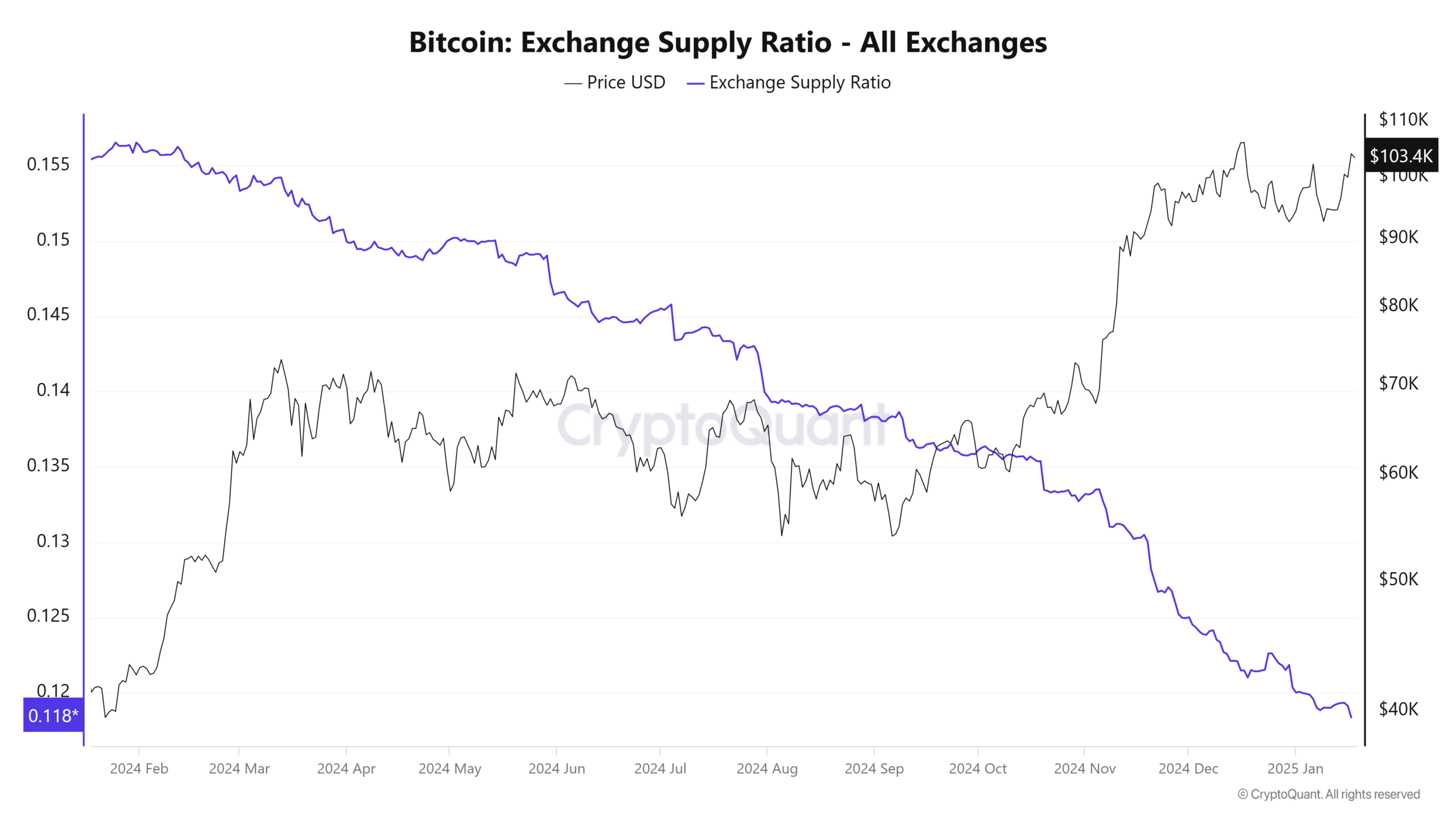

Moreover, Bitcoin’s Change provide ratio has declined to hit a yearly low – An indication that buyers are protecting their BTC off exchanges.

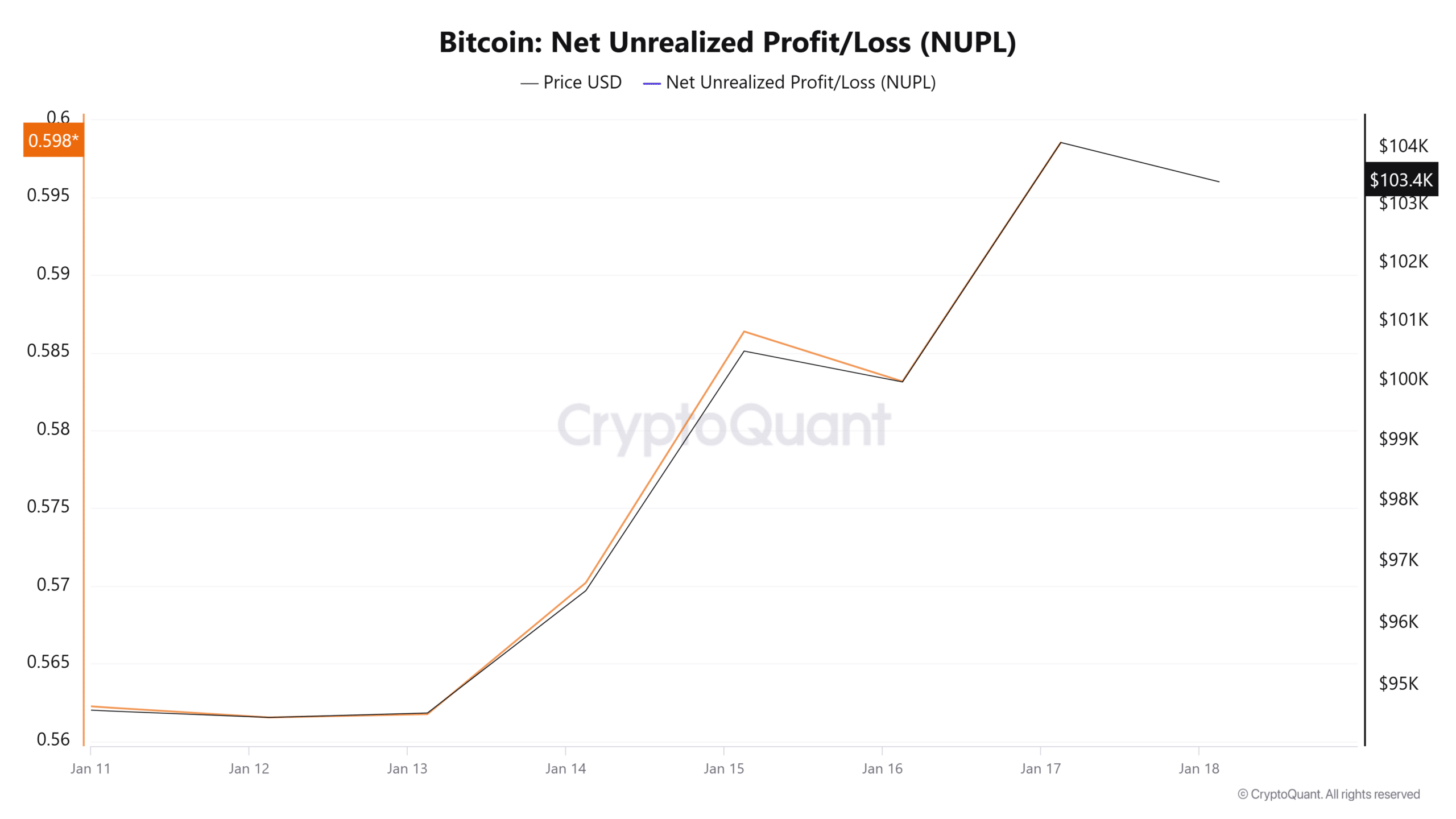

Lastly, Bitcoin’s NUPL has spiked over the previous week to hit 0.59.

Traditionally, NUPL values between 0.5 and 0.6 are seen through the center phases of bull markets, proper earlier than a parabolic worth rally.

How far can Bitcoin go?

Merely put, the dip witnessed earlier this week has strengthened BTC for a possible parabolic rally as buyers purchased the dip. Accompanied by constructive sentiment and optimism, Bitcoin could also be well-positioned for extra positive aspects now.

Due to this fact, if these market situations proceed to carry, Bitcoin will reclaim $108k and hit a brand new ATH within the close to time period. Due to this fact, a rally previous $200k, as predicted by Martinez, could also be far-fetched within the brief time period. Nevertheless, it’s possible in the long run.