- 61% of Ethereum holders remained in revenue regardless of current worth declines, exhibiting market resilience.

- Rising leverage and declining new addresses advised potential market volatility forward.

Ethereum [ETH] has been experiencing a downward development in current weeks, dropping beneath a number of key worth ranges.

This decline has culminated in a greater than 10% lower in its worth over the previous month, with the cryptocurrency now buying and selling at round $2,298, down 2% within the final week alone.

Regardless of this bearish motion, market analytics agency IntoTheBlock has offered some key insights into Ethereum and the state of its holders which will supply a extra nuanced view of the asset’s present state of affairs.

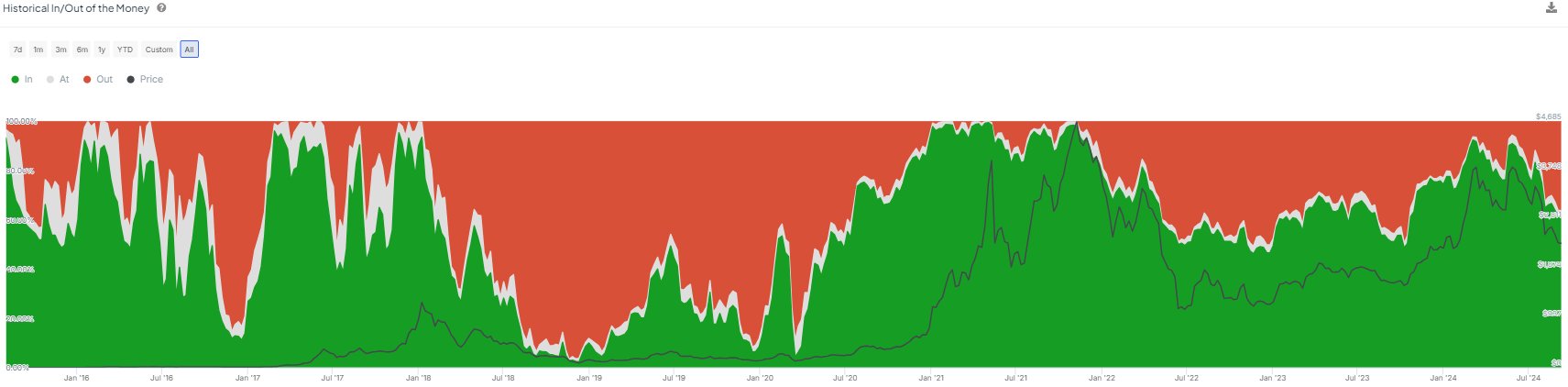

Ethereum holders: 61% in revenue

In response to a current evaluation by IntoTheBlock, 61% of Ethereum holders remained in revenue regardless of the continuing market hunch.

IntoTheBlock revealed that this determine mirrored a level of resilience amongst Ethereum holders, in comparison with earlier market cycles.

The analytics agency drew parallel to the earlier 12 months, noting that throughout the current bear market, the share of worthwhile holders dropped to a low of 46%.

After the 2017 market cycle, the share of addresses in revenue fell to a mere 3%.

This indicated that the present cycle demonstrates a stronger perception in Ethereum’s long-term worth.

IntoTheBlock notes that this resilience displays elevated confidence amongst holders, which can recommend a extra sturdy basis for Ethereum even throughout market downturns.

In response to IntoTheBlock, compared to the 2019-2020 interval, when profit-making addresses fell beneath 10%, the current state of affairs means that any potential downturn could also be much less extreme.

On-chain knowledge

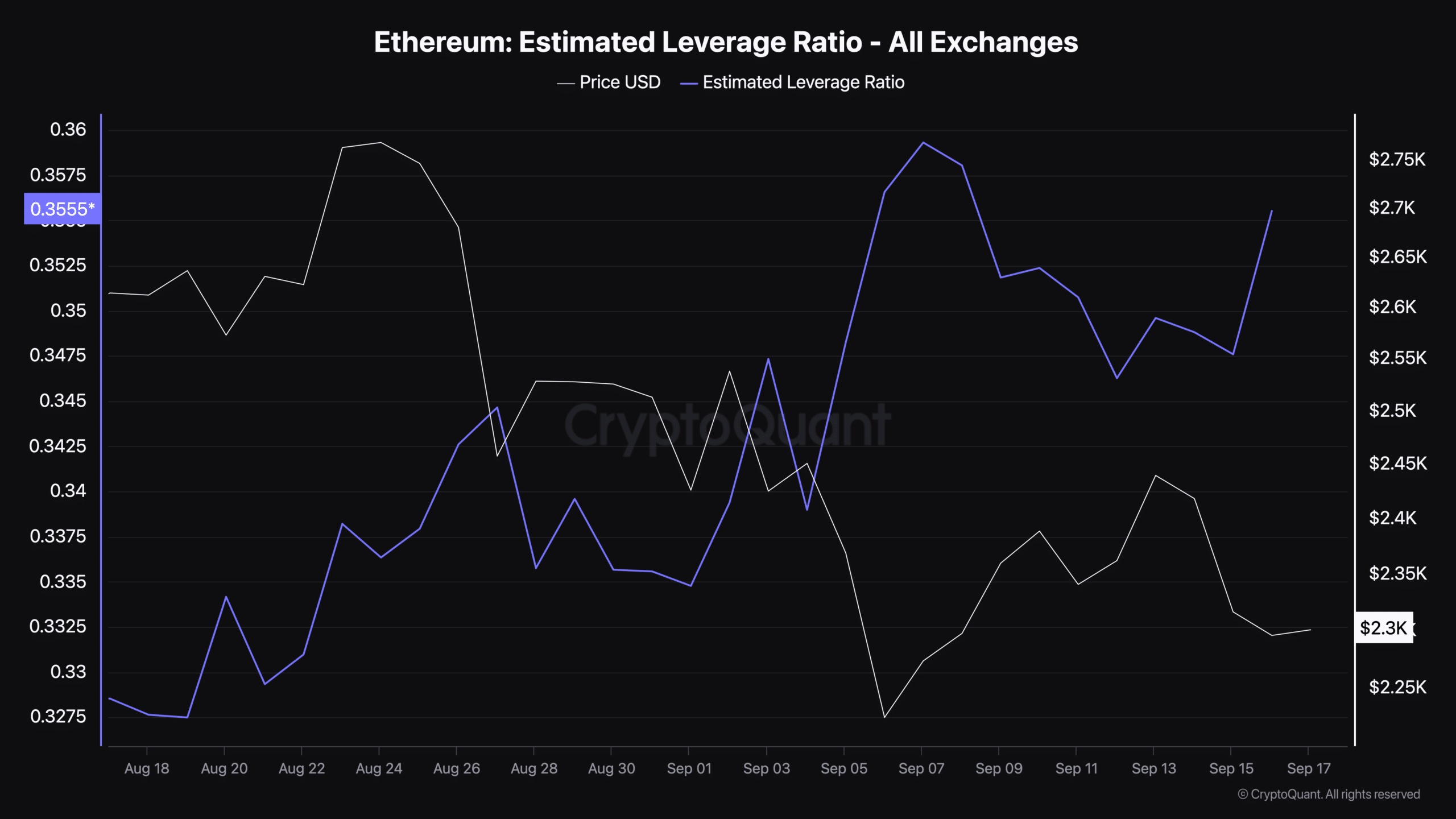

To additional perceive Ethereum’s present market place, it’s essential to look at a few of its key on-chain datasets. One such knowledge is the estimated leverage ratio.

In response to CryptoQuant, Ethereum’s estimated leverage ratio has seen a noticeable improve in current months, sitting at 0.355 at press time.

The estimated leverage ratio measures the diploma of leverage used within the derivatives market, evaluating the quantity of Open Curiosity to the overall quantity of cash held on exchanges.

An growing leverage ratio can point out heightened speculative activity, suggesting that merchants could also be taking over extra danger.

This development can result in greater worth volatility in both course, as extra leveraged positions improve the probability of liquidations, which might exacerbate worth actions.

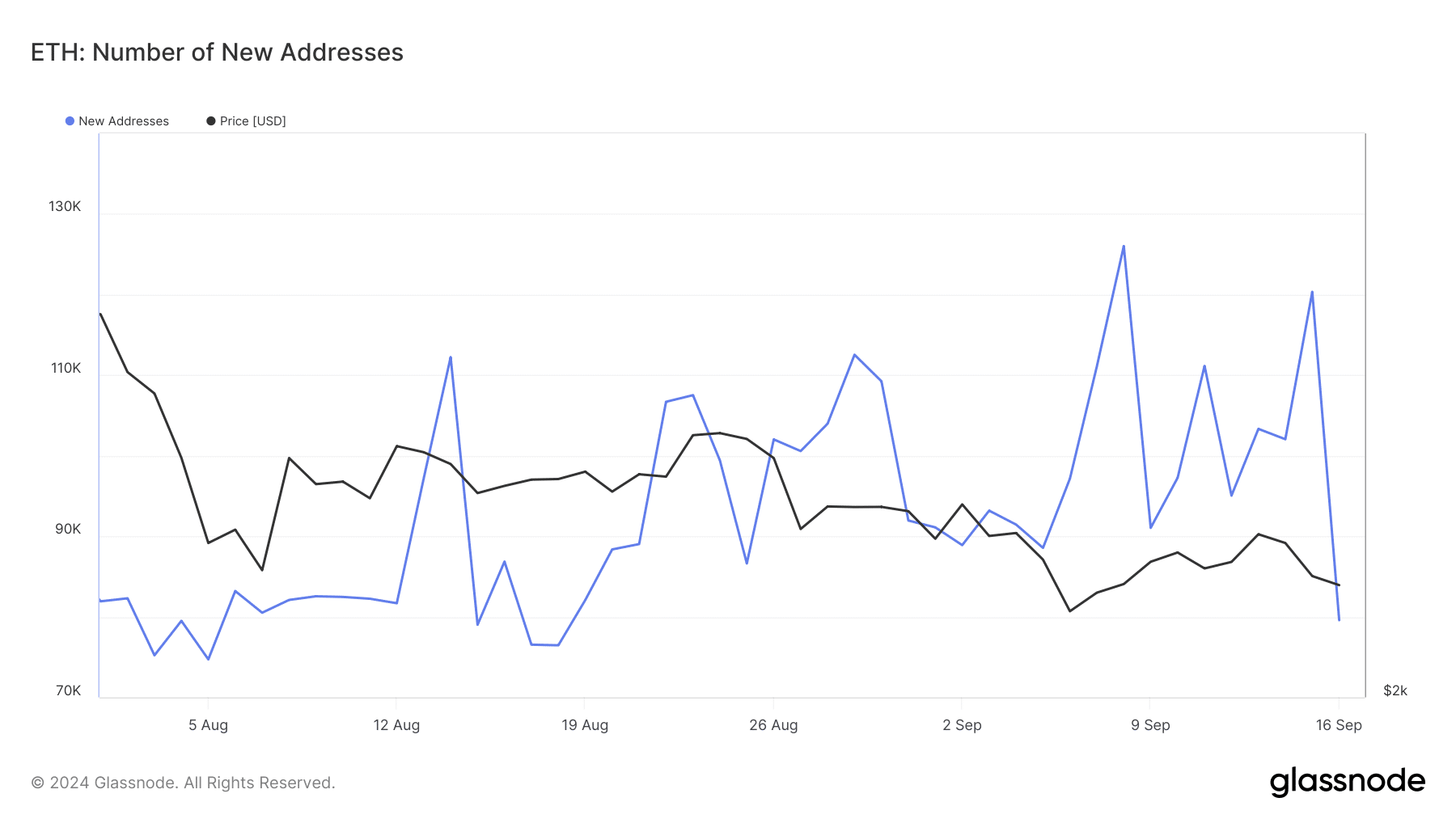

Along with the leverage ratio, the variety of new Ethereum addresses offers perception into community exercise and potential market sentiment.

Data from Glassnode revealed a decline within the variety of new addresses. After peaking above 126,000 on the sixth of September, the determine has since dropped sharply to round 79,000 new addresses.

A lowering variety of new addresses usually alerts lowered participation or curiosity within the community, which generally is a bearish indicator.

Learn Ethereum’s [ETH] Price Prediction 2024–2025

Decrease development in new addresses might indicate that fewer new traders are coming into the market, probably resulting in a lower in shopping for stress.

This decline in community exercise can contribute to the continuing downward stress on Ethereum’s worth, particularly when coupled with the rising leverage ratio.