- Grayscale information to transform its multi-crypto fund into spot ETF.

- Analysts warn of challenges due to XRP, SOL, and AVAX inclusion.

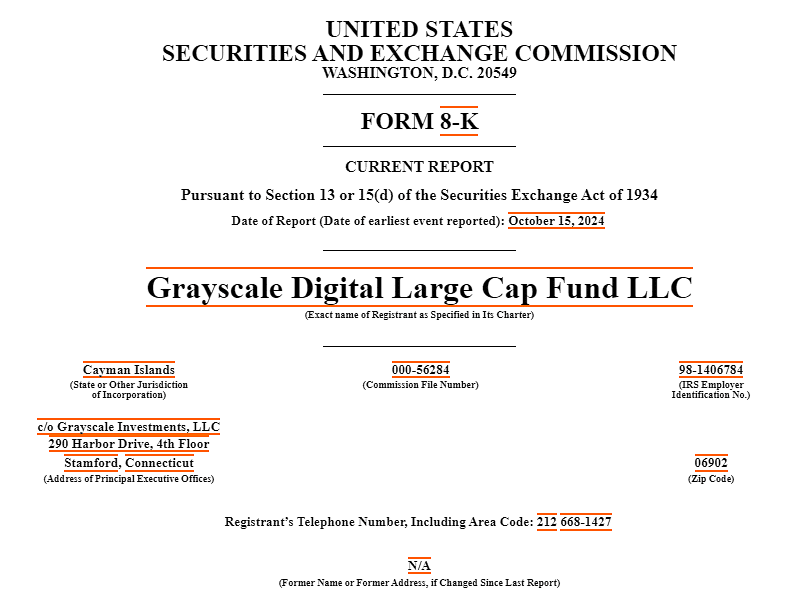

On the 14th of October, crypto asset supervisor Grayscale utilized with the U.S. SEC (Securities and Change Fee) to transform its multi-crypto fund into an ETF.

Presently, the agency’s Digital Massive Cap (GDLC) fund has $524 million in property below administration and spans Bitcoin [BTC], Ethereum [ETH], Solana [SOL], Ripple [XRP], and Avalanche [AVAX].

BTC and ETH dominated over 90% of the fund.

If authorised, the fund will probably be traded on the NYSE (New York Securities Change) per the filing. In a separate filing, the asset supervisor notified its traders of the proposed rule adjustments to the fund.

Crypto index ETF race

Changing a fund right into a spot ETF makes shopping for and promoting shares of the fund a lot simpler. Grayscale has transformed two funds linked to BTC (GBTC) and ETH (ETHE) into spot ETFs this 12 months.

Nevertheless, in the mean time, solely BTC and ETH are deemed commodities by the SEC. Actually, different issuers which have utilized related crypto index ETFs, like Hashdex and Franklin Templeton, solely included BTC and ETH of their purposes.

However Grayscale has included even XRP, which had no regulatory readability given its ongoing case with the SEC.

In keeping with Nate Geraci of ETF Retailer, the transfer might be a guess on a change in administration after the November U.S. elections. He stated,

“Looks like issuers are piling in on the “change in administration” guess…Mainly lining-up within the occasion of a Trump win w/ the idea that admin can be way more crypto-friendly.”

For its half, Presto Analysis, a crypto-focused analysis agency, viewed the appliance as a possible pathway to altcoin ETF approval.

“Its approval might probably pave the best way for future altcoin ETFs, equivalent to SOL, XRP, and AVAX, whose outlook for ETF eligibility has remained unclear below the present SEC.”

However Prestor Analysis analysts additionally famous that the appliance’s highway might be ‘bumpy’, citing spot SOL ETFs challenges in August.

That stated, Grayscale transformed ETFs have confronted intensified outflows, as seen in GBTC and ETHE. Since its conversion, GBTC has bled over $20 billion in whole flows whereas almost $3 billion in outflows in ETHE.

It stays to be seen how the appliance will proceed after the U.S. elections, and whether or not different altcoins with unclear regulatory standing will get authorised.