After Monday’s market crash, considerations in regards to the stability of Bitcoin’s bull run have emerged. But, Ki Younger Ju, founder and CEO of CryptoQuant, a number one blockchain analytics agency, maintains a optimistic outlook. He means that, regardless of the current crash, on-chain knowledge continues to assist the notion that the bull marketplace for Bitcoin stays intact.

Bitcoin On-Chain Evaluation: Bullish Arguments

#1 Bitcoin Hashrate

The Bitcoin hashrate, which gauges the computational energy utilized in mining and processing transactions, is nearing an all-time excessive (ATH). Ju notes, “Miner capitulation is almost over, with hashrate nearing ATH. US mining prices are ~$43K per BTC, so hashrate probably secure except costs dip under this.”

#2 Whale Conduct

Important Bitcoin inflows into custody wallets are one other argument to be bullish, indicating sturdy accumulation by large-scale buyers, sometimes called ‘whales’. Ju highlights, “Important BTC inflows into custody wallets. Everlasting Holder addresses elevated by 404K BTC, together with 40K BTC in US spot ETFs over the past 30 days. New whales are accumulating.”

Associated Studying

#3 Retail Investor Participation

The present subdued participation of retail investors is much like patterns noticed in mid-2020. Ju remarks, “Retail buyers are largely absent, much like mid-2020.” This absence would possibly contribute to much less volatility, as retail buying and selling usually results in speedy worth swings.

#4 Outdated Whales Nonetheless HODL

Between March and June, long-term holders (those that have held for over three years) transferred their Bitcoin holdings to newer buyers. At present, there isn’t any vital promoting strain from these veteran holders.

Bearish On-Chain Information

#1 Macro Dangers

On the draw back, Ju factors out macroeconomic dangers and up to date market actions that would affect Bitcoin’s worth stability: “Macro dangers may result in compelled sell-offs. There have been massive crypto deposits by Jump Trading just lately, and Binance hit YTD excessive in every day deposits.”

Associated Studying

#2 Borderline On-Chain Indicators

Whereas some on-chain indicators have just lately turned bearish, these are borderline, based on Ju. He asserts, “Some on-chain indicators turned bearish however are borderline. If bearish tendencies persist for over two weeks, market restoration might be difficult.”

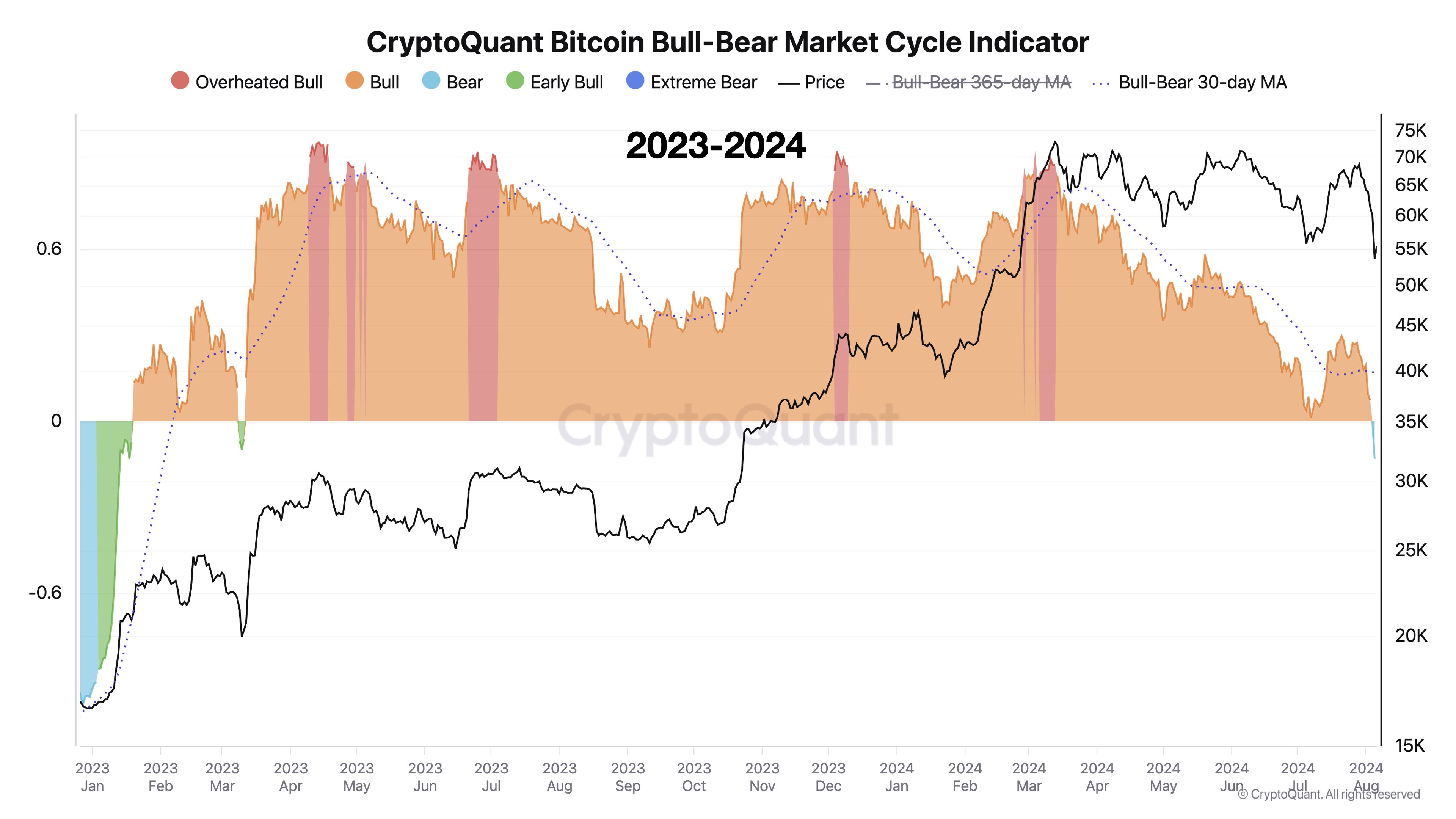

#3 Bull-Bear Cycle Indicator Flags Bear Part

Notably, the Bull-Bear Market Cycle Indicator has additionally flagged a bear part for the primary time since January 2023 (excessive blue space within the chart), warranting shut remark. CryptoQuant Head of Analysis Julio Moreno added that this indicator has beforehand recognized restricted bear phases throughout vital market occasions just like the COVID sell-off in March 2020 and the Chinese language mining ban in Could 2021. Furthermore, it additionally accurately anticipated the beginning of the bear market in November 2021.

Regardless of these bearish undercurrents, Ju stays cautiously optimistic in regards to the potential of Bitcoin to achieve a brand new all-time excessive till the tip of the yr. “So long as the Bitcoin worth stays above $45K, it may break its all-time excessive once more inside a yr, imo. Some indicators are exhibiting bearish signals. Nevertheless, they may nonetheless recuperate with a rebound, so we have to watch if it stays at this stage for per week or two. If it lingers longer, the danger of a bear market grows, and restoration could also be troublesome if it lasts over a month,” Ju concludes.

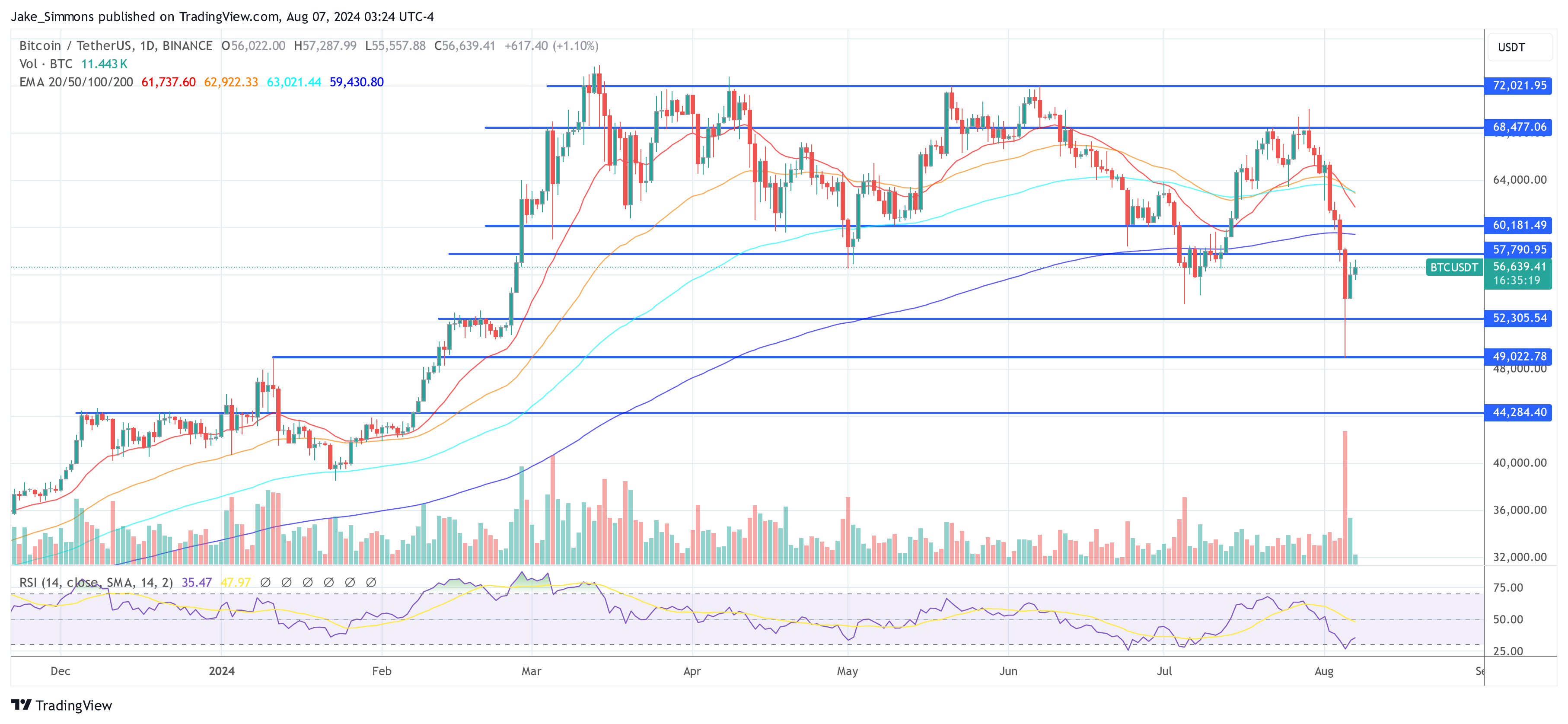

At press time, BTC traded at $56,639.

Featured picture created with DALL.E, chart from TradingView.com