Cause to belief

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Created by trade consultants and meticulously reviewed

The best requirements in reporting and publishing

Strict editorial coverage that focuses on accuracy, relevance, and impartiality

Morbi pretium leo et nisl aliquam mollis. Quisque arcu lorem, ultricies quis pellentesque nec, ullamcorper eu odio.

Bitcoin’s worth motion up to now 48 hours has seen it approaching the $80,000 worth stage once more, with dangers of breaking to the draw back. Taking a look at on-chain knowledge reveals a notable assist stage between $80,920 and $78,000 that must not be broken.

Associated Studying

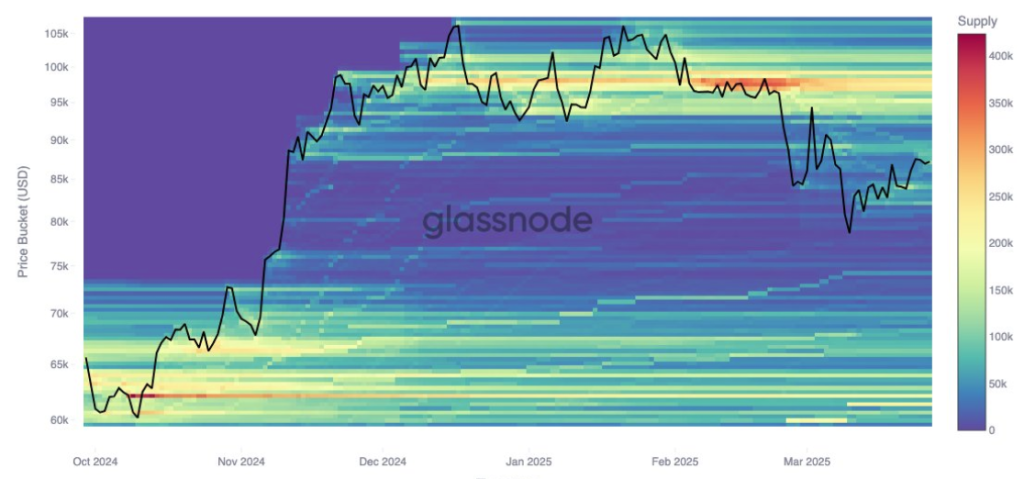

Significantly, on-chain analytics from Glassnode level to a thinning of assist on the $78,000 stage, the place solely minimal value foundation clusters now exist. The perception follows a pointy transfer that noticed savvy merchants scoop up practically 15,000 Bitcoin on the March 10 low earlier than cashing out on the $87,000 native prime.

Help Cushion Rises With Clusters Between $80,000 And $84,000

Bitcoin began the month of March with a loopy crash that noticed its worth hit under $77,000 on March 10 and March 11. A lot of the month was spent by Bitcoin embarking on a restoration from this stage, finally reaching as excessive as $88,500 final week.

Apparently, on-chain data from Glassnode reveals that some Bitcoin merchants took benefit of the crash and bought about 15,000 BTC at this low. Nonetheless, many addresses from this similar cohort offered on the $87,000 native prime, abandoning a depleted buffer zone which will now not supply the identical worth stability.

Bitcoin’s strongest value foundation clusters have steadily migrated upward from $78,000 all through the month, with essentially the most distinguished assist ranges now sitting between $80,920 and $84,100. Roughly 20,000 BTC had been acquired at $80,920, 50,000 BTC at $82,090, and one other 40,000 BTC at round $84,100. These contemporary accumulations are actually the brand new zones of confidence amongst current patrons which will supply cushions for the current market dip.

On the time of writing, Bitcoin is buying and selling at $83,120, that means that it has misplaced the zone of 40,000 BTC round $84,100. This places the onus on $82,090 and, subsequently, the $80,920 worth ranges. Nonetheless, if the correction sharpens additional, it wouldn’t be till after $78,000 that structural support reappears at $74,000 and $71,000, the place long-term conviction shopping for occurred, estimated at 49,000 BTC and 41,000 BTC, respectively.

Picture From X: Glassnode

$95,000 Value Foundation Cluster Grows With Cooling Demand

As assist continues to climb step by step, resistance appears to be firming close to the $95,000 mark. Investor value foundation knowledge reveals a rise of 12,000 BTC clustered at this stage since March 24.

This means that some buyers now anticipate a prime forming round $95,000, and promoting exercise might develop into extra pronounced if costs method that zone. This resistance, alongside the assist ranges, might see Bitcoin confined inside a narrowing vary within the quick time period.

Associated Studying

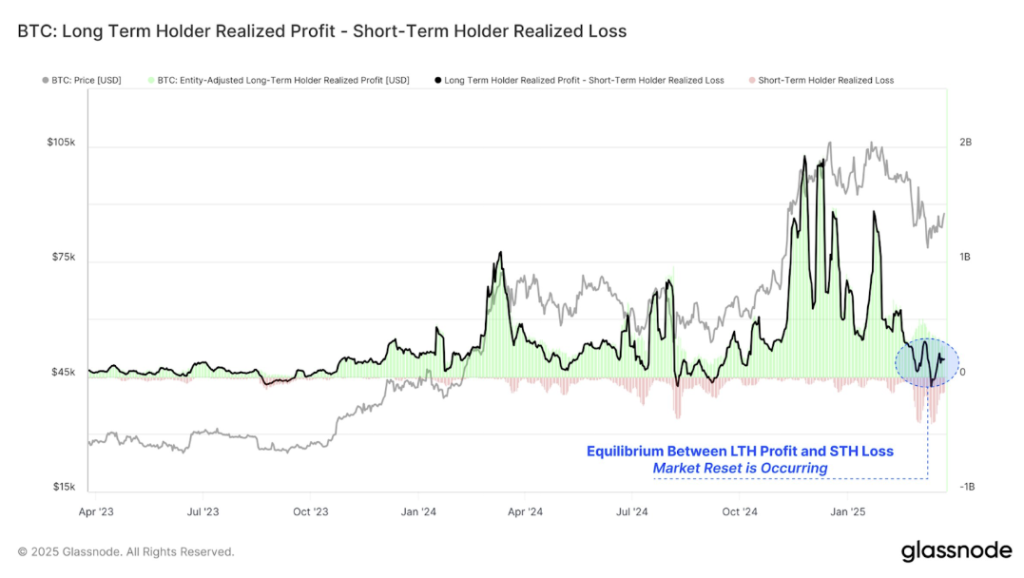

Glassnode knowledge confirms that long-term holders (addresses holding Bitcoin for greater than 150 days) have been the first supply of profit-taking for some time. Lengthy-term holders’ profit-taking is now practically matched by the losses endured by short-term merchants who’ve been holding Bitcoin for lower than 155 days.

Picture From X: Glassnode

Featured picture from Tech Analysis On-line, chart from TradingView