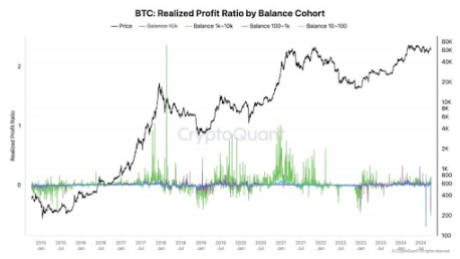

Ki Young Ju, the founding father of the on-chain analytics platform CryptoQuant, revealed that Bitcoin whales are at the moment transferring out of character when it comes to profit-taking. These whales probably consider that the bull is way from over, which is why they haven’t secured as a lot revenue as they’ve accomplished in previous bull runs.

Bitcoin Whales Have Taken Lesser Income In This Market Cycle Than Previous Ones

Ki Younger Ju talked about in an X publish that if the Bitcoin bull cycle had been to finish right here, it will imply that Bitcoin whales have simply set the file for the least profit-taking throughout all cycles ever. Crypto analyst Ali Martinez tried to counter Ki Younger Ju’s level by highlighting how these whales have been distributing their BTC throughout completely different addresses, resulting in a drop within the variety of addresses holding between 1,000 and 10,000 BTC.

Associated Studying

Nonetheless, the CryptoQuant founder claimed that that is nonetheless the bottom return price throughout all cycles, irrespective of how a lot these whales offered by means of these completely different wallets. He additionally revealed that the whales which can be promoting now are doing so with little revenue, suggesting that they’re probably new whales with weak fingers.

In the meantime, Ki Young Ju famous that the kind of transactions that Martinez alluded to can’t at all times be thought of as gross sales. He remarked that one should have a look at extra macro-level aggregated knowledge, equivalent to historic realized revenue, moderately than simply transactions to get the larger image.

These whales are believed to be holding again on taking earnings simply but, contemplating that the bull run seems to be to be removed from over. The CryptoQuant CEO additionally talked about earlier that Bitcoin was nonetheless in the course of a bull run primarily based in the marketplace cap to realized cap metric.

As a substitute of taking earnings, these Bitcoin whales are nonetheless accumulating extra BTC forward of the subsequent leg of the bull run. CryptoQuant not too long ago revealed that there was a surge within the outflows from exchanges, the most important since November 2022. In the meantime, Ki Younger Ju additionally noted that new whales are accumulating at a price the market has by no means witnessed earlier than.

When Is This Market Cycle Anticipated To Peak?

Crypto analysts like Rekt Capital have predicted that the Bitcoin market top may happen someday in mid-September or mid-October 2025. Nonetheless, in a recent report, CoinMarketCap provided a special opinion, predicting that the cycle prime may doubtlessly be between mid-Could and mid-June 2025.

Associated Studying

The platform famous that Bitcoin is at the moment forward of historic developments, particularly contemplating that it hit a brand new all-time high (ATH) earlier than the Halving occasion. CoinMarketCap identified that this market cycle is accelerating by roughly 100 days, which signifies that the subsequent peak may arrive before anticipated.

Featured picture created with Dall.E, chart from Tradingview.com