- BTC continues to say no as federal charges cuts hypothesis persists.

- An analysts eyes a restoration to $62000 after FED choice.

Bitcoin [BTC] has skilled excessive volatility over the the previous month. Whereas it has tried to interrupt the September curse for the previous week, the crypto has lacked sufficient momentum for the uptrend.

The final week has seen BTC transfer from an area low of $52546 to an area excessive of $60,670. Nevertheless, over the previous 24 hours, it has skilled fluctuation dropping a lot of the positive aspects. As of this writing, BTC was buying and selling at 58,552. This marked a 2.38% decline over the previous week.

Previous to this, Bitcoin was in upsurge rising by 5.98% on weekly charts. Whereas the crypto has declined over the previous 24 hours, its buying and selling quantity has surged. Actually, the previous day has seen a 100% improve in buying and selling quantity to $26.9 billion.

The present market circumstances have sparked widespread dialogue. This has left many analysts see the potential of upcoming Fed charges because the trigger.

In style crypto analyst Hasan has urged federal cuts are one of many components driving market sentiment.

What’s subsequent for Bitcoin?

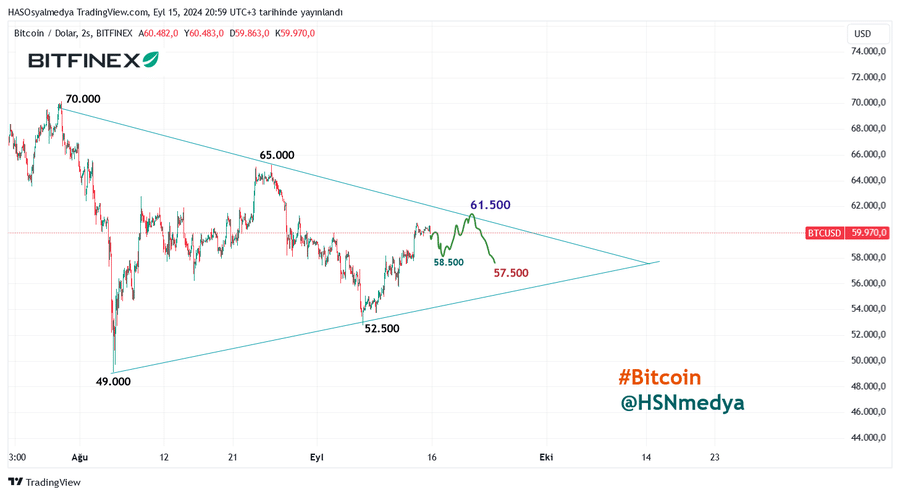

In his evaluation, Hasan cited the upcoming federal cuts this week as the primary issue driving market uncertainty.

In accordance with his evaluation, BTC markets will expertise a sell-off of round $58500 making this the important assist degree till the Federal cuts choice is out.

Nevertheless, the analyst posits that though the markets could expertise some sell-off at this degree, he expects restoration from this degree to $61500.

Subsequently, if the FED publicizes 25 foundation level rate of interest cuts, BTC will get better and worth gross sales will surge to the $61500 and $62000 vary.

Nevertheless, if the market experiences a correction following the FED choice, BTC costs will decline to $57500.

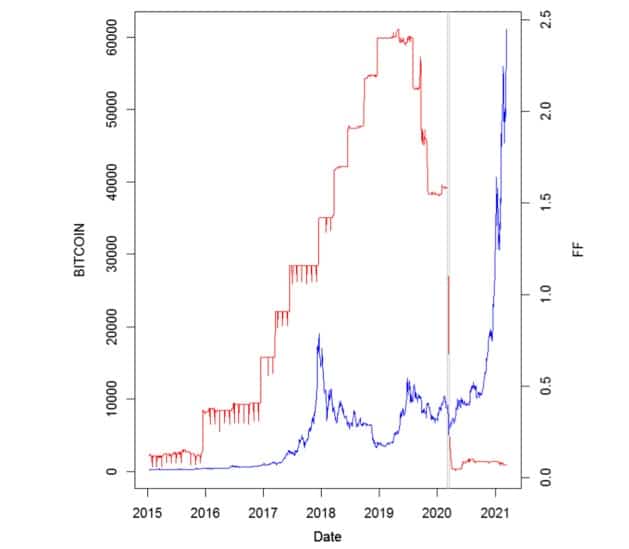

Traditionally, federal charge cuts have positively impacted BTC costs. As an example, in 2020 March, BTC costs surged surpassing its earlier highs following the cuts ensuing from the COVID-19 financial shock.

Subsequently, the anticipated charge cuts after 4 years are prone to improve money stream amongst retail and institutional merchants thus rising the BTC fund stream ratio. Nevertheless, if the crypto abandons the historic tendency, it is going to expertise additional correction.

What BTC charts counsel

As famous by Hasan, the market uncertainty has elevated over the FED charge cuts anticipation. Thus till then, the present market circumstances present additional decline.

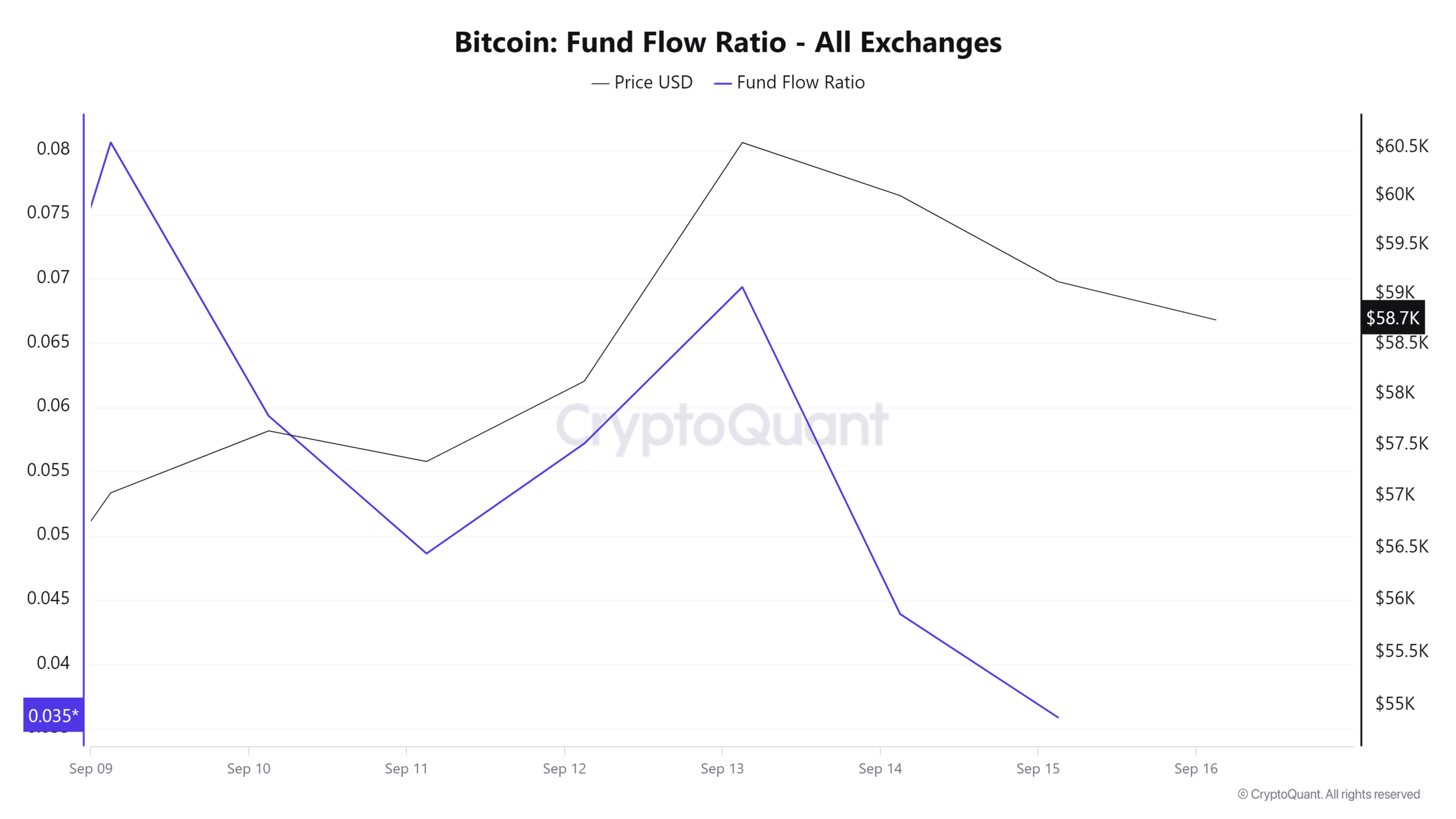

For instance over the previous week, Bitcoin’s fund stream ratio from a excessive of 0.08 to 0.03. The decline suggests extra funds are exiting the market than these coming into. This stream is supported by a 100% improve in buying and selling quantity.

Thus, these buying and selling actions are inflicting promoting strain which additional pushes costs down.

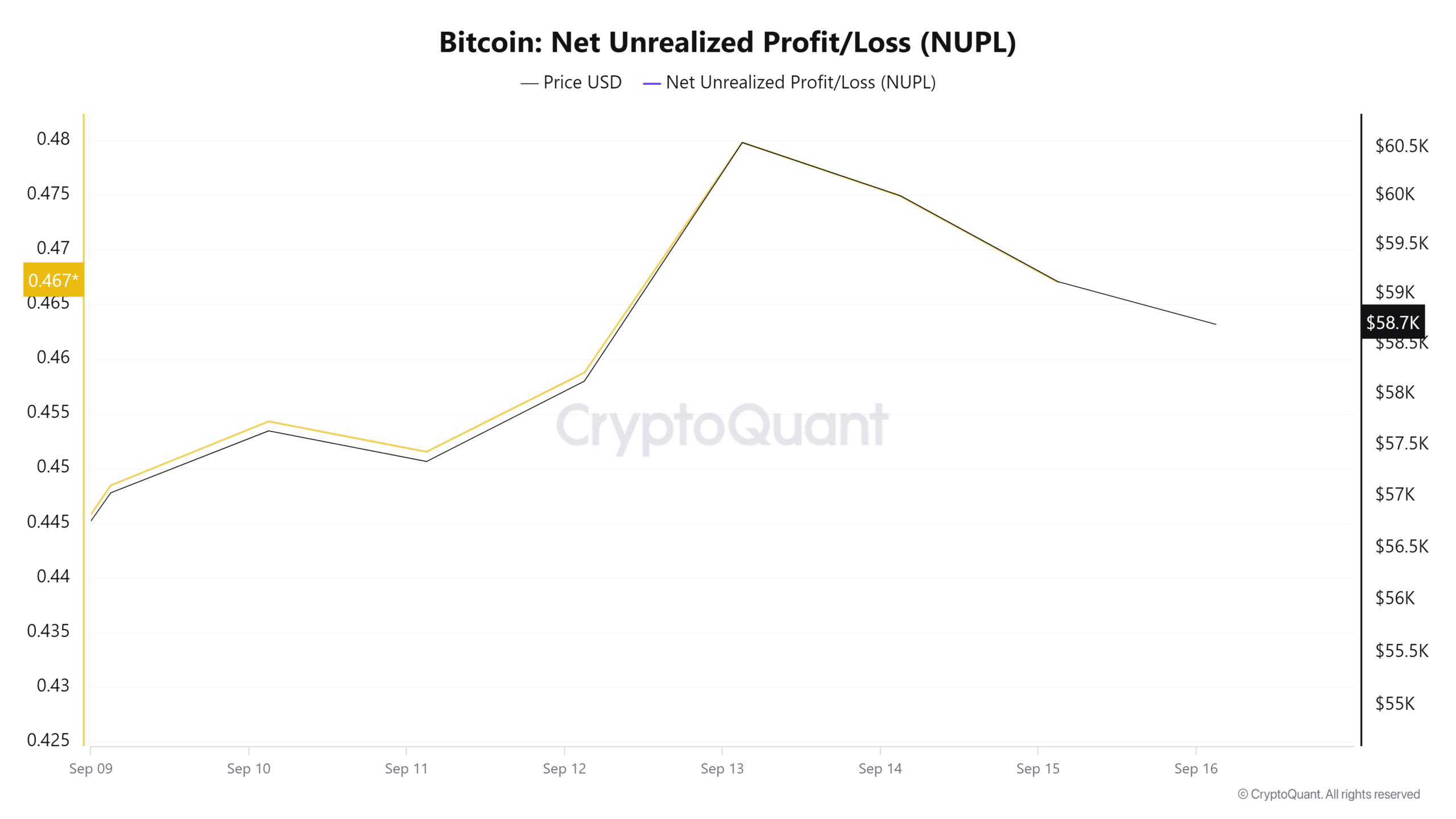

Moreover, BTC’s internet unrealized revenue/loss has declined over the previous 3 days. This means that there’s a lower within the variety of holders in revenue whereas these in losses improve.

Such a market situation results in bearish sentiment as traders begin to panic and promote to keep away from additional losses. This additional results in increased promoting strain.

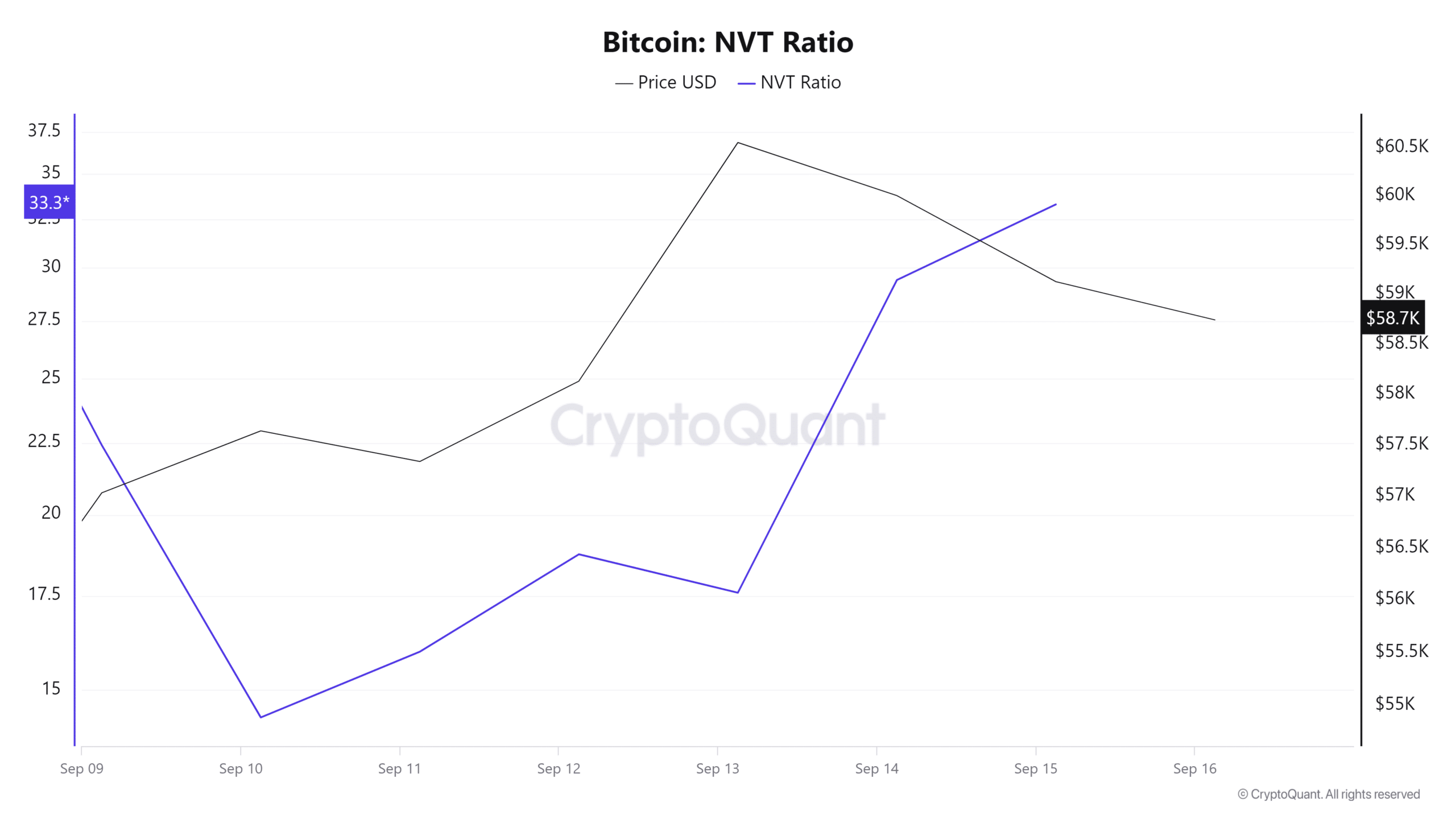

Lastly, Bitcoin’s NVT Ratio has elevated over the previous week from a low of 14.3 to 33.3. A rise within the NVT ratio means that the current worth improve resulted from speculative shopping for.

Learn Bitcoin’s [BTC] Price Prediction 2024-25

Thus the current worth progress is unsustainable with out ample fundamentals to again it up. This leads to correction for market compatibility, and that’s what BTC is experiencing after the current spike.

Subsequently, till FED charges are reduce, BTC will expertise additional decline. If the market reacts positively to imminent charge cuts, it is going to problem $62852. Nevertheless, if the market experiences a correction, it is going to decline to $57,342.