- The markets noticed an inflow in Ethereum into spinoff exchanges.

- Latest charts confirmed a attainable 4-hour bullish divergence on ETH.

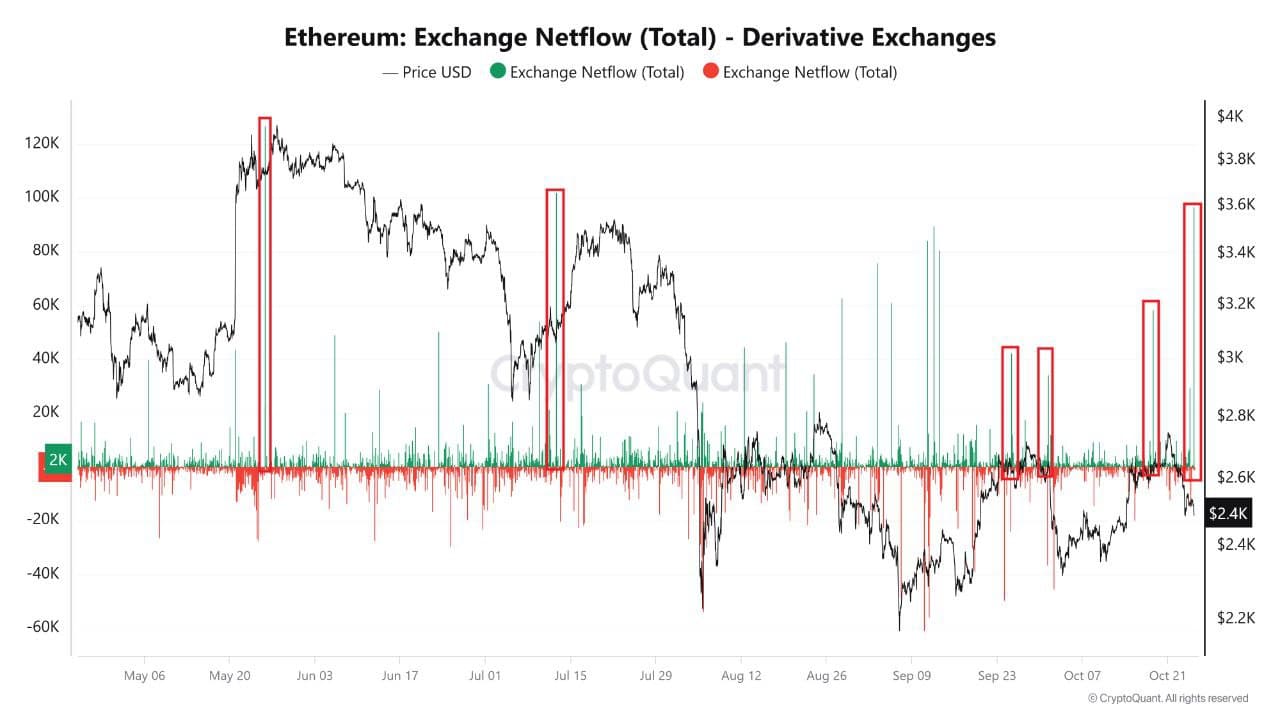

Ethereum [ETH], being one of many main cryptocurrencies, has been the topic of dialogue as an inflow of 96000 ETH into spinoff exchanges lately indicated a notable rise in market exercise.

Traditionally, related inflows led to ETH worth swings or downturns, as seen in Might and July this yr. This improve may sign one other worth correction or presumably arrange a serious market shift.

Because the yr’s ultimate quarter unfolds, Ethereum’s efficiency may carefully observe Bitcoin’s latest breakout from a chronic consolidation, which spurred optimism throughout crypto markets.

U.S. elections accompanied by a divergence sign

Ethereum’s worth motion in previous U.S. election cycles additionally supported this pattern. Through the 2020 elections, ETH surged, breaking out of consolidation.

With the elections now simply days away, the same sample may happen.

Ethereum may see a rebound if historical past repeats itself, notably as many anticipate optimistic insurance policies on crypto beneath potential modifications within the U.S. administration.

Nonetheless, this final result stays speculative as the general financial and crypto panorama has advanced since 2020.

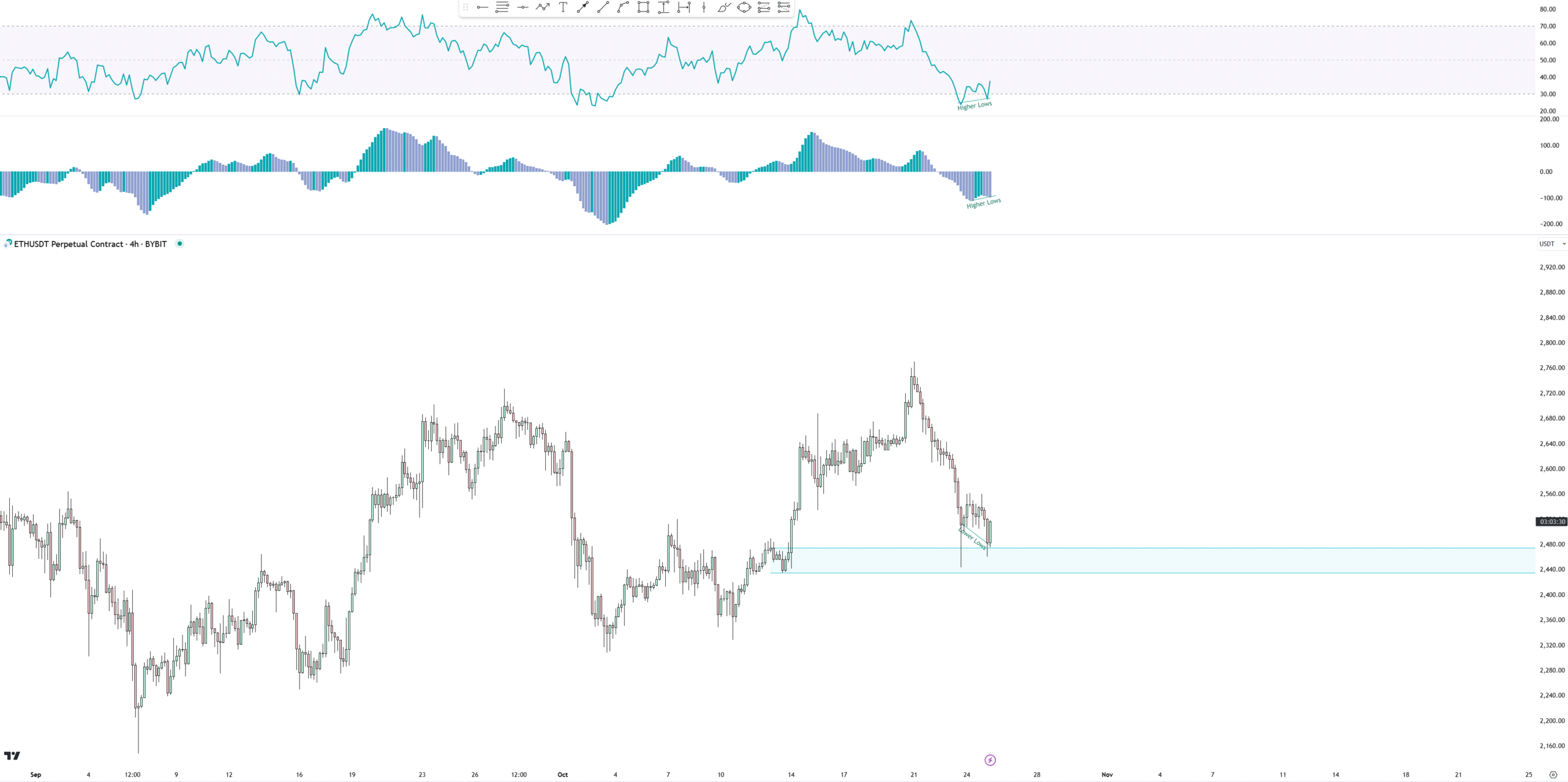

Supporting a possible bullish flip for ETH, latest charts confirmed a attainable 4-hour bullish divergence, signaling a shift in demand.

Though the construction of this demand stage appeared irregular, Ethereum confirmed reactions that would point out power.

The divergence construction was clear, and it displayed a double divergence with a clear arc formation, giving a optimistic outlook.

A lot of the unfavourable delta appeared on the primary leg of this sample, which usually indicators much less promoting strain on the second leg.

Nonetheless, analysts steered warning and suggested merchants to attend for a powerful inexperienced candle, confirming a reversal, earlier than assuming this may invalidate the bearish outlook.

ETH/BTC testing its 2016 highs

In one other key improvement, Ethereum examined its 2016 highs towards Bitcoin. At the moment, ETH is buying and selling beneath a long-standing falling wedge sample, which represents a high-timeframe help stage.

Many merchants anticipate ETH may proceed to appropriate towards Bitcoin, particularly if it struggles to interrupt above this stage.

Though Ethereum has proven resilience within the latest market, investor curiosity remained subdued, holding its future worth motion unsure.

Ought to ETH respect this help, it may appeal to recent market curiosity, probably initiating a market shift both within the remaining months of the yr or early subsequent yr.

Learn Ethereum’s [ETH] Price Prediction 2024–2025

Nonetheless, till ETH confirms a breakout, a cautious outlook stays prudent for buyers.

Whereas important inflows, election-year developments, and a attainable bullish divergence fueled hopes for a rally, ETH should navigate key resistance ranges towards Bitcoin.