- ETH reserves spiked by over 100,000 within the final 24 hours alone

- On the worth charts, the altcoin climbed to over $2,400

Throughout its final buying and selling session, Ethereum’s value noticed an honest transfer, however the actual spotlight was the spike in its trade reserves. In reality, information pointed to a noticeable hike in ETH being moved to exchanges – An indication that some holders could be desirous to promote.

Quite the opposite, the netflow information revealed that patrons managed to steadiness out the stream with sufficient demand to soak up the incoming provide. This equilibrium between patrons and sellers allowed ETH to shut the buying and selling session on a optimistic word.

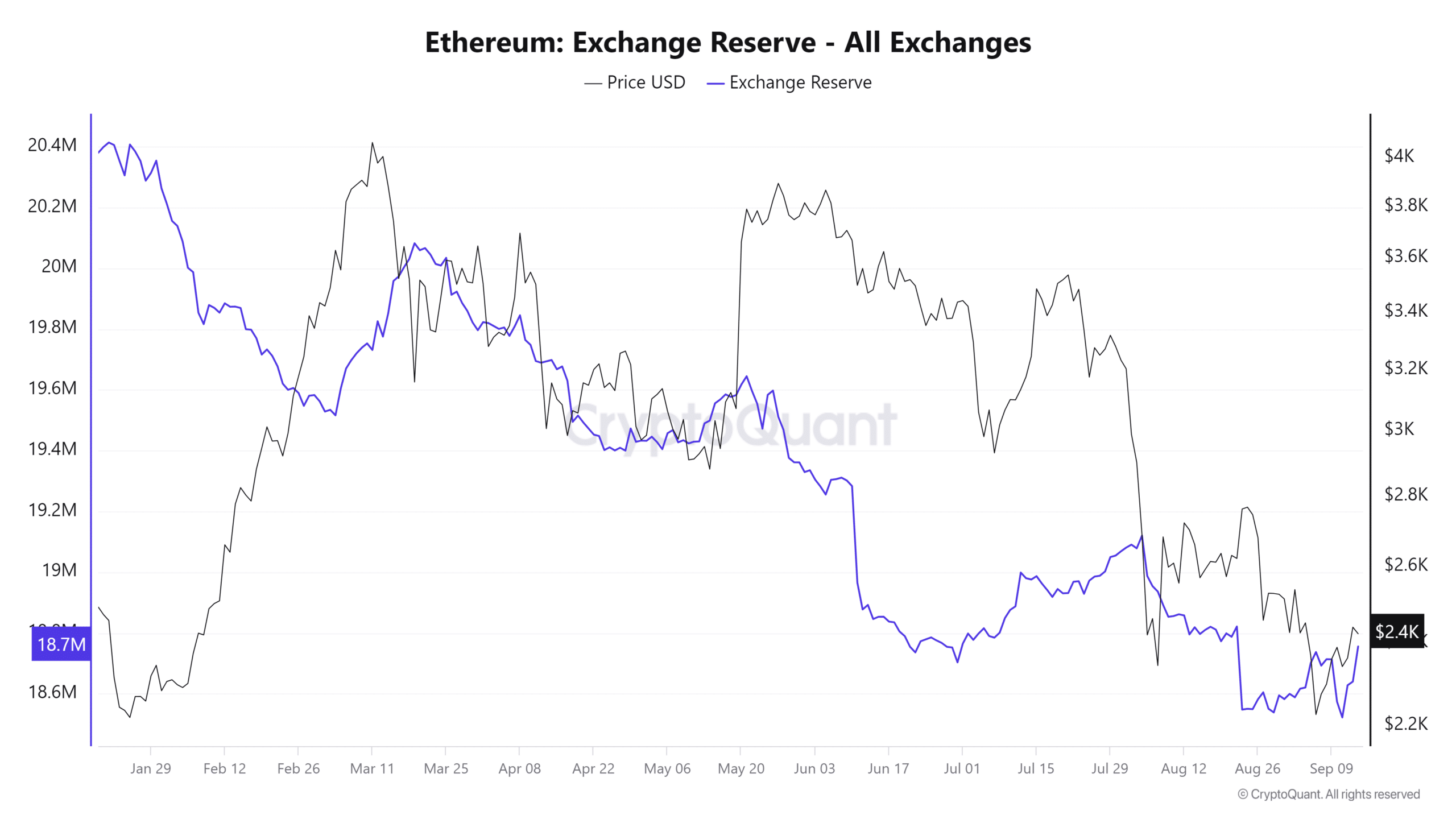

Ethereum reserves spike

An evaluation of the Ethereum trade reserve on CryptoQuant revealed a major spike over the past 24 hours.

On 13 September, the amount of the ETH reserves stood at round 18.6 million. Nonetheless, it has since surged to roughly 18.755 million, marking a rise of over 100,000 ETH inside a day. That is the primary time in nearly a month that the trade reserves have seen such a major quantity.

It additionally signifies that extra merchants have moved their ETH to exchanges over the aforementioned interval.

This spike sometimes means that merchants are getting ready to promote, as transferring property to exchanges usually alerts intentions to liquidate holdings. Right here, the worth development might have influenced this motion, with merchants probably in search of to capitalize on current beneficial properties.

Moreover, their actions doubtless contributed to the worth fluctuations, including to the stress on Ethereum within the brief time period.

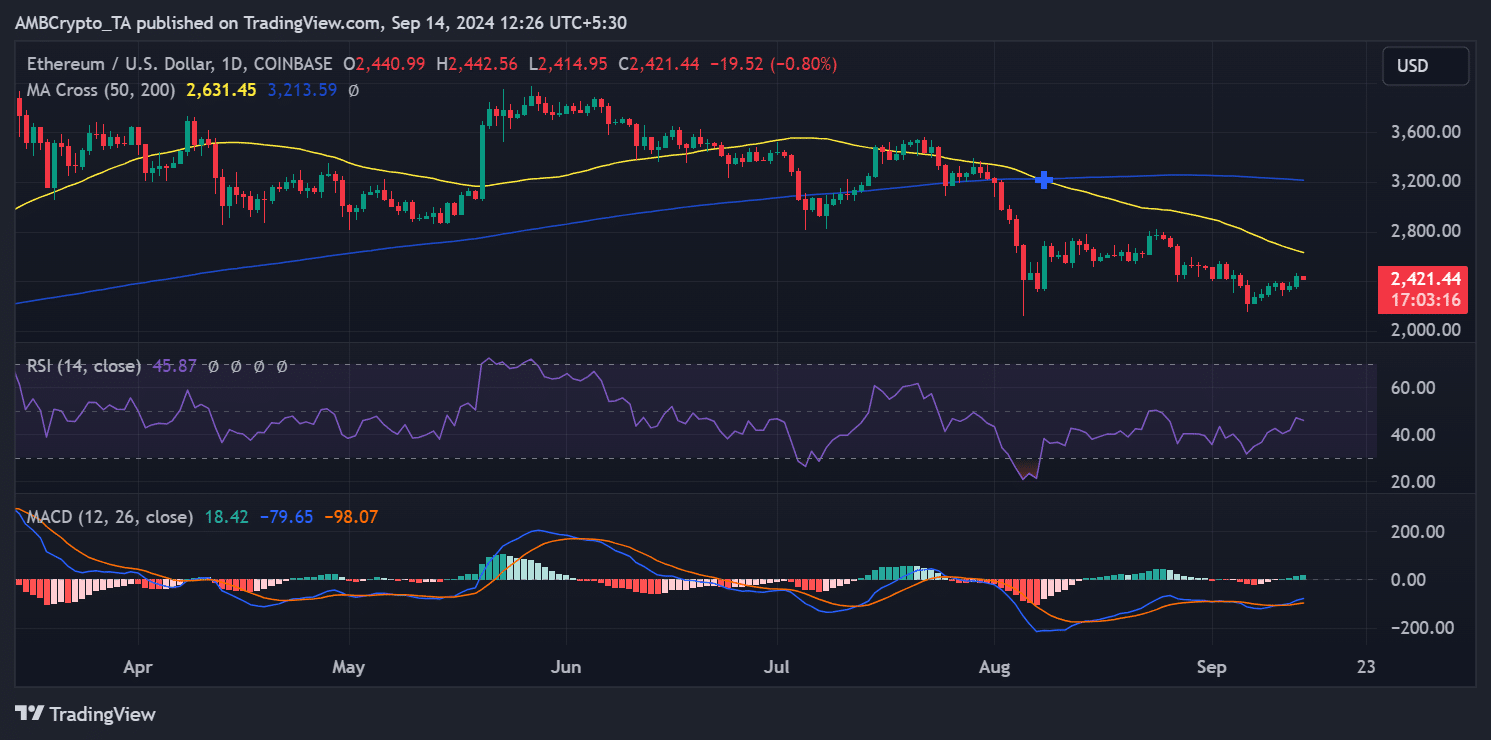

ETH pulls close to its impartial line

An evaluation of Ethereum’s day by day value development from the final buying and selling session revealed a major upward transfer.

ETH opened at roughly $2,361 and closed at round $2,440, gaining by over 3% through the session. This motion marked the primary time in over per week that ETH revisited the $2,400 value degree.

The value hike doubtless triggered the spike in trade reserves as merchants moved ETH to exchanges for potential profit-taking.

Nonetheless, the truth that the worth ended greater suggests that there have been extra patrons than sellers, balancing the influx of ETH to exchanges. The surge in demand helped soak up promoting stress. This allowed the worth to shut positively.

Regardless of this, the Relative Energy Index (RSI) remained close to the impartial line, indicating a bigger bearish development. On the time of writing, ETH had misplaced among the beneficial properties from its earlier session and was buying and selling at round $2,420.

This pointed to a minor pullback following the upward motion. Nonetheless, Ethereum’s means to carry close to the $2,400 degree could possibly be a optimistic signal for bullish momentum within the close to time period if patrons stay energetic.

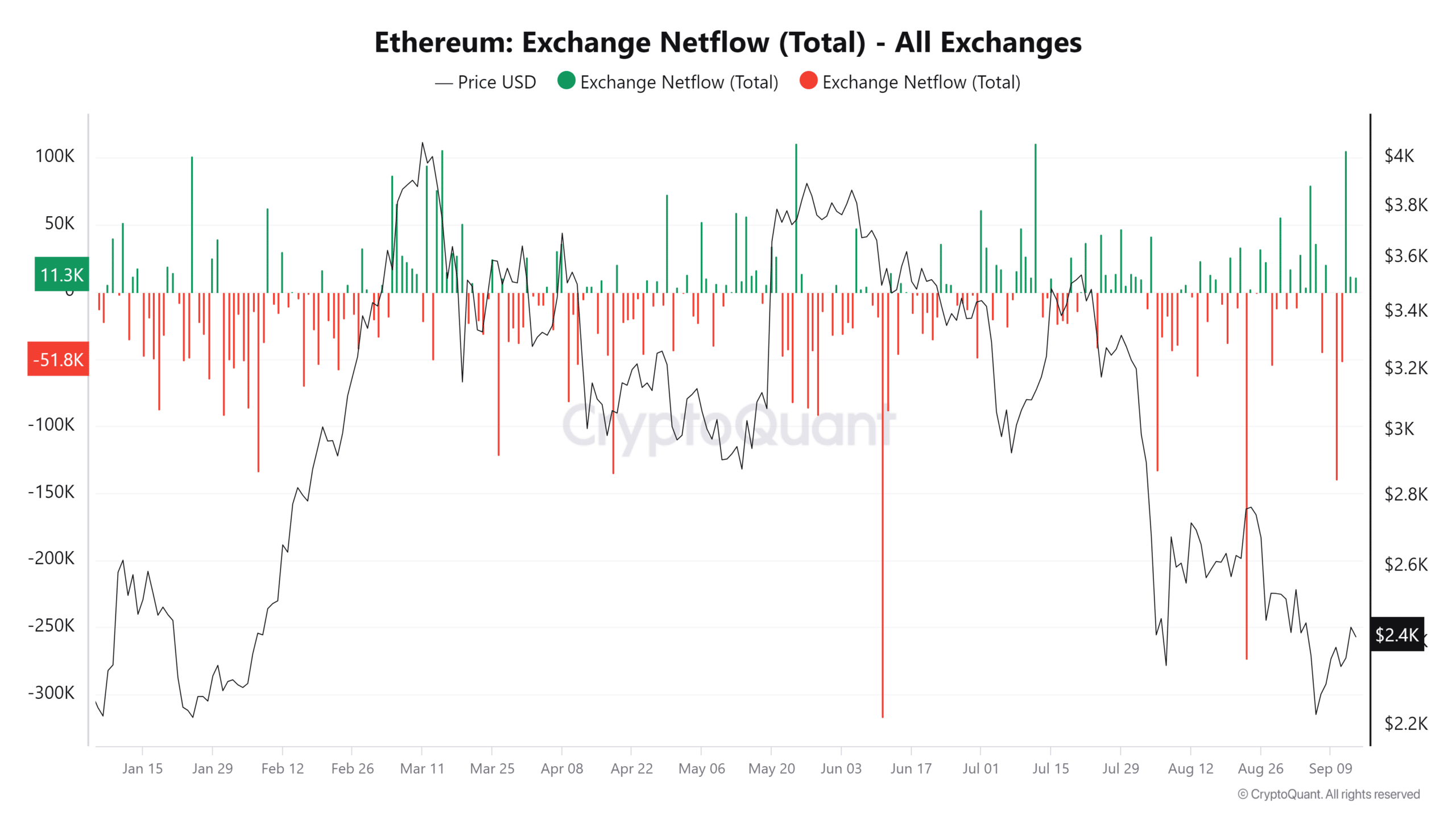

Ethereum netflows flash optimistic, however…

An evaluation of Ethereum’s netflows over the last buying and selling session revealed optimistic netflows of over 12,000 ETH, in response to CryptoQuant.

Optimistic netflows imply that extra ETH was despatched to exchanges than withdrawn, suggesting that extra merchants have been promoting their holdings. Nonetheless, contemplating the numerous spike in trade reserves, this would possibly seem comparatively low.

Nonetheless, a more in-depth have a look at the information revealed that whereas there was a rise in ETH deposits, withdrawals, doubtless by patrons, had been on the upper facet too. Because of this exchanges noticed almost balanced inflows and outflows, with patrons withdrawing ETH as quick as sellers had been depositing it.

– Learn Ethereum (ETH) Price Prediction 2024-25

This netflows development is an indication that regardless of the hike in ETH transferring to exchanges, shopping for curiosity was sturdy sufficient to soak up the promoting stress, almost offsetting the deposits.

This steadiness between patrons and sellers helped ETH keep its value ranges, even because it famous fluctuations out there. The relative steadiness in netflows is a optimistic signal for Ethereum’s value stability within the brief time period.