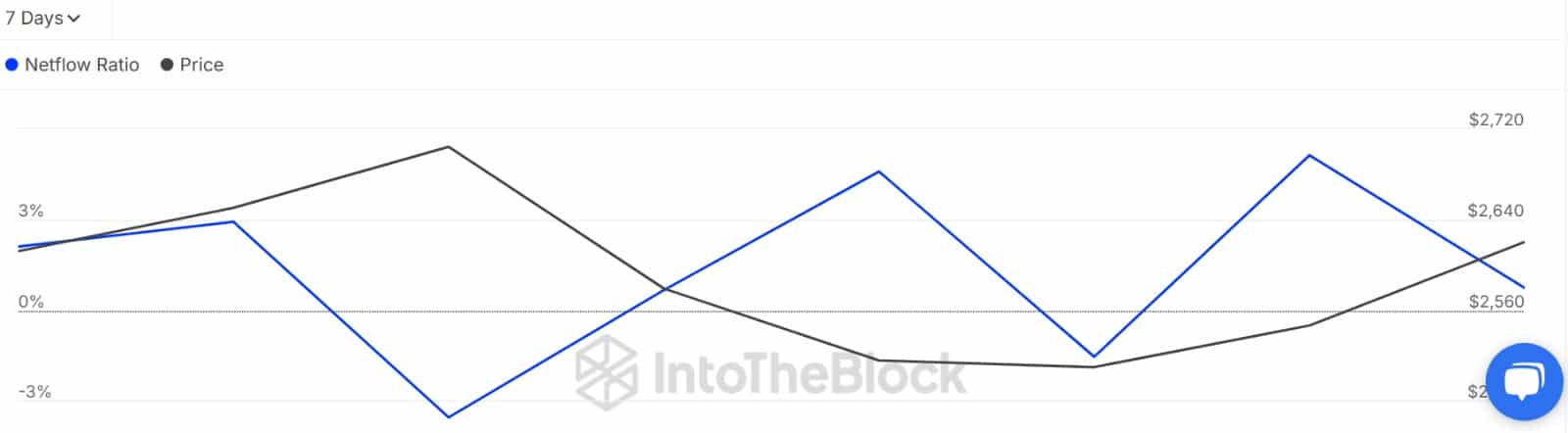

- Ethereum’s Spot Netflow stayed unfavourable for seven days, signaling regular accumulation throughout investor segments.

- Market makers have re-entered with accumulation-heavy exercise, hinting at structural help for an upward transfer.

Ethereum [ETH] continued to commerce sideways, however beneath the floor, momentum gave the impression to be constructing.

Whereas market gamers had taken a step again because the market stagnated, on-chain information indicated the Ethereum ecosystem is extra energetic than ever earlier than.

ETH market makers are again within the sport

As such, Aphractal founder Joao Wedson observed that Ethereum market makers had returned with pressure.

Based on his Wyckoff-based evaluation, each accumulation and distribution patterns have been enjoying out in tandem, however accumulation appeared to dominate.

In fact, this wasn’t simply hypothesis.

Ethereum is seeing robust accumulation from all market contributors. For starters, Ethereum’s Spot Netflow stayed unfavourable for a full week, confirming constant outflows from exchanges.

This means that there are extra consumers than sellers available in the market. At the moment, there are consumers of all sizes; as an example, Ethereum whales are additionally making aggressive purchases.

The Giant Holders Netflow to Change Netflow Ratio additionally backed this view. It dropped sharply from 4.28% to 0.62%, implying whales had pulled again from alternate exercise.

This means that whales usually are not promoting Ethereum as a substitute, they’re shopping for.

Elevated shopping for exercise has seen consumers dominate the market over the previous day. Thus, the ETH Taker Purchase-Promote Ratio turned constructive.

A constructive ratio right here means that traders available in the market are largely shopping for. As such, there are extra purchase orders executed with consumers lifting gives reflecting robust accumulation throughout the market.

Can ETH lastly breakout?

As noticed above, Ethereum is experiencing vital accumulation, setting the altcoin up for a significant transfer. Thus, the longer this accumulation lasts, the larger the transfer shall be.

A breakout above $2,660 would open the door to $2,830—an space stacked with excessive liquidity, which may entice aggressive strikes.

Nevertheless, Ethereum should clear this zone with conviction. If it does, the following key resistance sits at $3,000.

To maintain this setup alive, bulls should defend the $2,556 help. A breakdown beneath this degree may invalidate the bullish thesis.