A crypto analyst identified for precisely calling Bitcoin’s pre-halving correction final yr believes that BTC must reclaim a key technical indicator as assist to regain bullish momentum.

Pseudonymous crypto strategist Rekt Capital tells his 542,600 followers on the social media platform X that BTC seems to be mirroring its worth motion in 2021 when Bitcoin consolidated between two key exponential transferring averages (EMAs) on the weekly chart.

In line with Rekt, Bitcoin should convert the 21-week EMA into assist to set off the resumption of bullish worth motion.

“Earlier this week, Bitcoin rejected from the 21-week EMA resistance (inexperienced).

In consequence, Bitcoin continues to consolidate between these two Bull Market EMAs, very similar to it did in mid-2021.

Nonetheless, for the long run, the important thing affirmation sign for a breakout will likely be a weekly shut above the inexperienced EMA adopted by a post-breakout retest of it into new assist (gentle blue circle).”

At time of writing, Bitcoin is buying and selling for $82,536.

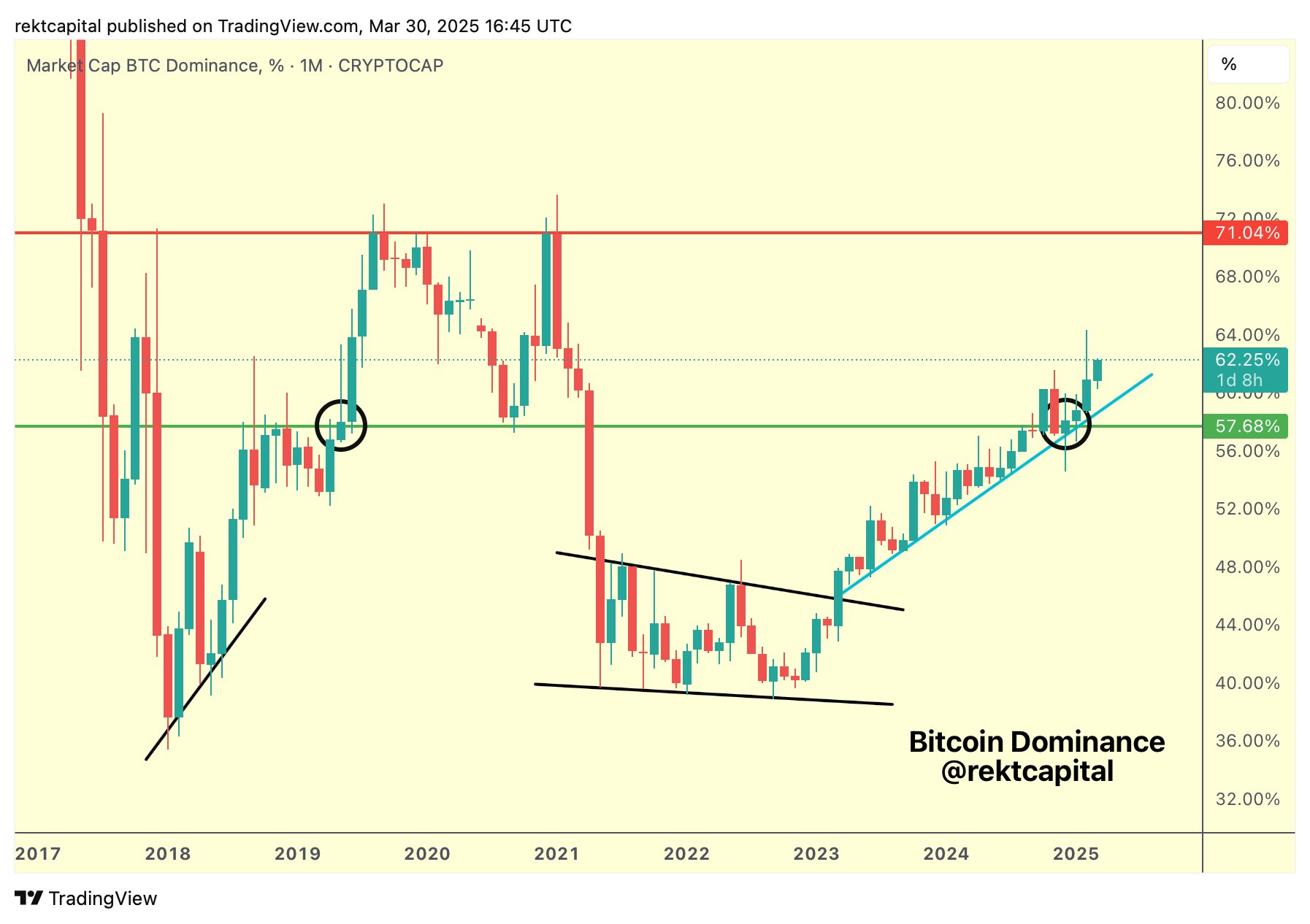

Trying on the altcoin market, the dealer says he expects alts to proceed underperforming Bitcoin based mostly on the BTC dominance (BTC.D) chart, which tracks how a lot of the entire crypto market cap belongs to the flagship digital asset.

In line with Rekt, BTC.D might hit an important resistance stage that has remained intact since 2017 earlier than dropping steam. As soon as that occurs, Rekt predicts that an actual altcoin season will come to fruition.

“BTC Dominance.

If historical past repeats, the actual Altseason all people is ready for would start as soon as Bitcoin Dominance rejects from 71% (crimson).”

A bearish BTC.D chart means that altcoins are rising in worth sooner than Bitcoin. At time of writing, BTC.D is hovering at 62.26%.

Comply with us on X, Facebook and Telegram

Do not Miss a Beat – Subscribe to get e-mail alerts delivered on to your inbox

Examine Price Action

Surf The Daily Hodl Mix

Disclaimer: Opinions expressed at The Day by day Hodl are usually not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your individual threat, and any losses it’s possible you’ll incur are your accountability. The Day by day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital property, neither is The Day by day Hodl an funding advisor. Please be aware that The Day by day Hodl participates in affiliate internet marketing.

Generated Picture: Midjourney