Ethereum’s (ETH) efficiency has come below sharp scrutiny following claims by a number one crypto pundit that the network is “dying.” The remakes surfaced after contemporary information revealed a staggering decline in ETH’s revenue and core fundamentals, elevating questions on its long-term sustainability regardless of worth milestones.

Ethereum Income Decline Sparks “Dying” Narrative

Messari Crypto Enterprise Analysis Supervisor, AJC, ignited controversy on X social media after boldly declaring that “Ethereum is dying.” His assertion facilities on the steep decline within the community’s income regardless of ETH achieving new all-time highs in August 2025.

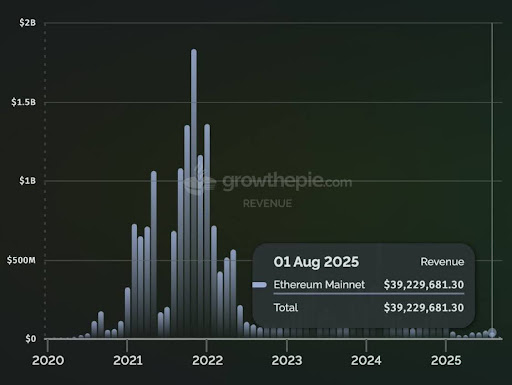

In keeping with information, Ethereum generated simply $39.2 million in income for the month—a drastic 75% plunge from August 2023’s $157.4 million and a 40% crash from the $64.8 million recorded in August 2024. Alarmingly, it represents the fourth-lowest month-to-month income since January 2021.

The income chart shared by the Messari analysis supervisor additionally paints a regarding image. Ethereum beforehand noticed income peaks exceeding $1 billion throughout the highest 2021 and 2022 exercise, pushed by Decentralized Finance (DeFi) and NFT booms. Nevertheless, income has since cooled to historic lows, exhibiting an prolonged downtrend that has not reversed regardless of bullish worth motion.

AJC’s central level is that Ethereum’s fundamentals, which had been as soon as touted because the spine of its long-term worth, are eroding. He argues that the broader group seems detached to those crimson flags so long as ETH’s market price continues to climb.

Crypto Group Pushes Again On ETH Dying Claims

Whereas AJC’s statements have gained traction, they’ve additionally sparked intense pushback from crypto and ETH group members. A widely known crypto commentator, David Hoffman, criticized the notion of evaluating Ethereum solely as a revenue-generating community. He argued that ETH’s essence lies in its function as a decentralized ecosystem, remodeling it into the “quickest rising rising financial system.”

AJC acknowledged Hoffman’s perspective however disagreed with the notion that Ethereum is the fastest-growing financial system. The Messari analysis supervisor burdened that ETH’s actual benefit over Bitcoin lies in its place as a tech platform. If that basis falters, he cautioned, Ethereum might lose all claims of superiority to BTC.

Different business voices added nuance to the controversy. Rick, a analysis analyst at Messari, countered that Ethereum can’t be declared “dying” when exercise metrics akin to app income, stablecoin supply, and layer-2 scaling are hitting document highs. He described Ethereum as essentially the most flourishing decentralized monetary system up to now.

AJC, nonetheless, dismissed these indicators as deceptive. He argued that stablecoin issuers skew app revenues, whereas metrics like active addresses or throughput fail to seize actual demand. He additional said that stablecoin progress solely issues if it will increase transaction velocity, and scaling options are meaningless with out marginal person demand.

In the meantime, one other group member, Leon Lanza, argued that Ethereum shouldn’t be in comparison with tech shares, stressing its commodity-like qualities. In keeping with him, commodities will not be valued strictly on income. AJC countered that even inside that framework, income stays crucial since it’s denominated in ETH and traditionally drives consumption demand.

Featured picture from Adobe Inventory, chart from Tradingview.com

Editorial Course of for bitcoinist is centered on delivering completely researched, correct, and unbiased content material. We uphold strict sourcing requirements, and every web page undergoes diligent assessment by our workforce of prime expertise consultants and seasoned editors. This course of ensures the integrity, relevance, and worth of our content material for our readers.