- BTC should overcome robust resistance on the $88K–$90K vary to take care of bullish momentum amid the $16.5B choices expiry.

- A excessive focus of Bitcoin name choices close to $90K and declining quantity trace at potential profit-taking or a pause within the rally.

A record-breaking $16.5 billion value of Bitcoin [BTC] choices are set to run out on the twenty eighth of March, sparking intense hypothesis in regards to the asset’s subsequent main transfer.

As merchants brace for this vital occasion, the choices market and technical indicators flash essential indicators that would form Bitcoin’s near-term route.

Choices market sees bullish tilt, however heavy clusters stay

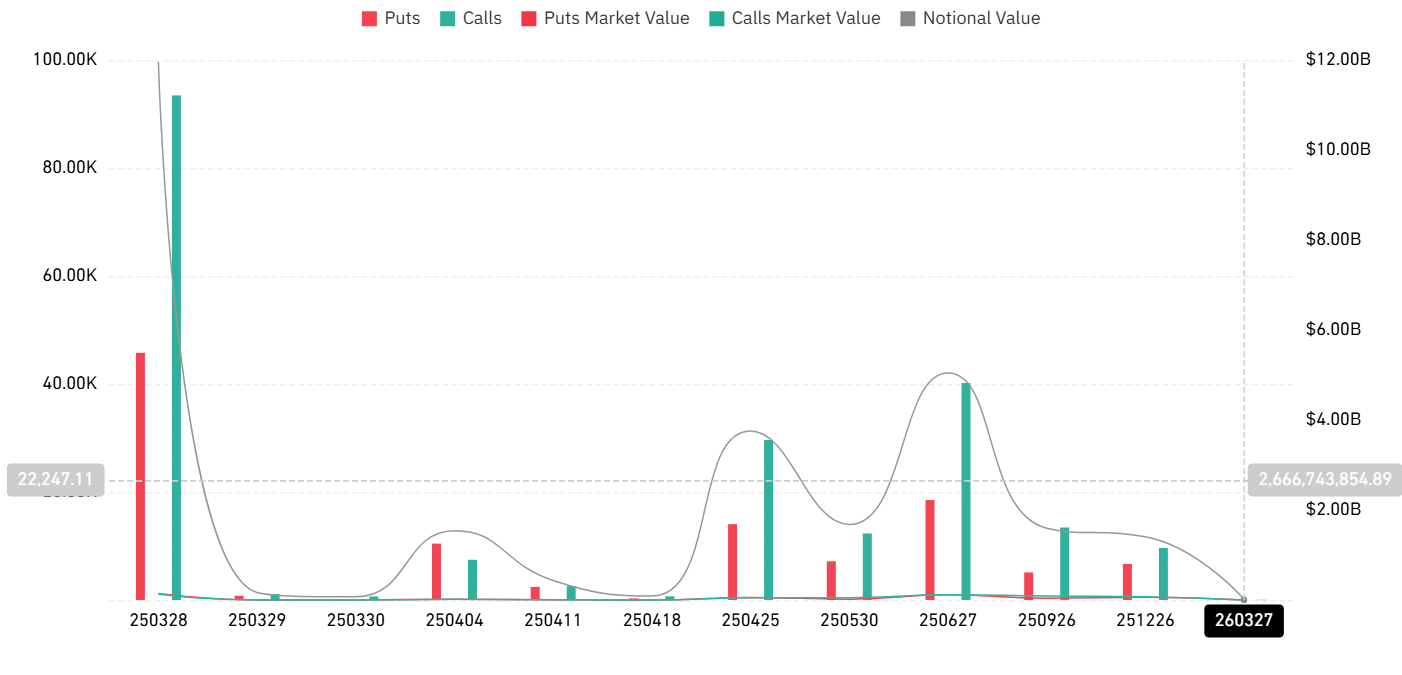

Knowledge from Coinglass reveals large Open Curiosity (OI) close to the $90K strike worth, with a notable tilt towards name choices.

The notional worth of the excellent contracts has reached an all-time excessive, highlighting elevated market publicity.

Curiously, a big focus of name choices lies across the $90K and $95K marks, suggesting that bulls are betting on a breakout past these resistance ranges.

Nonetheless, there’s additionally a large put cluster close to the $80K-$82K vary, which suggests a failure to climb above $90,000 may set off downward strain if merchants hedge their positions aggressively.

Bitcoin’s technical setup hints at warning regardless of momentum

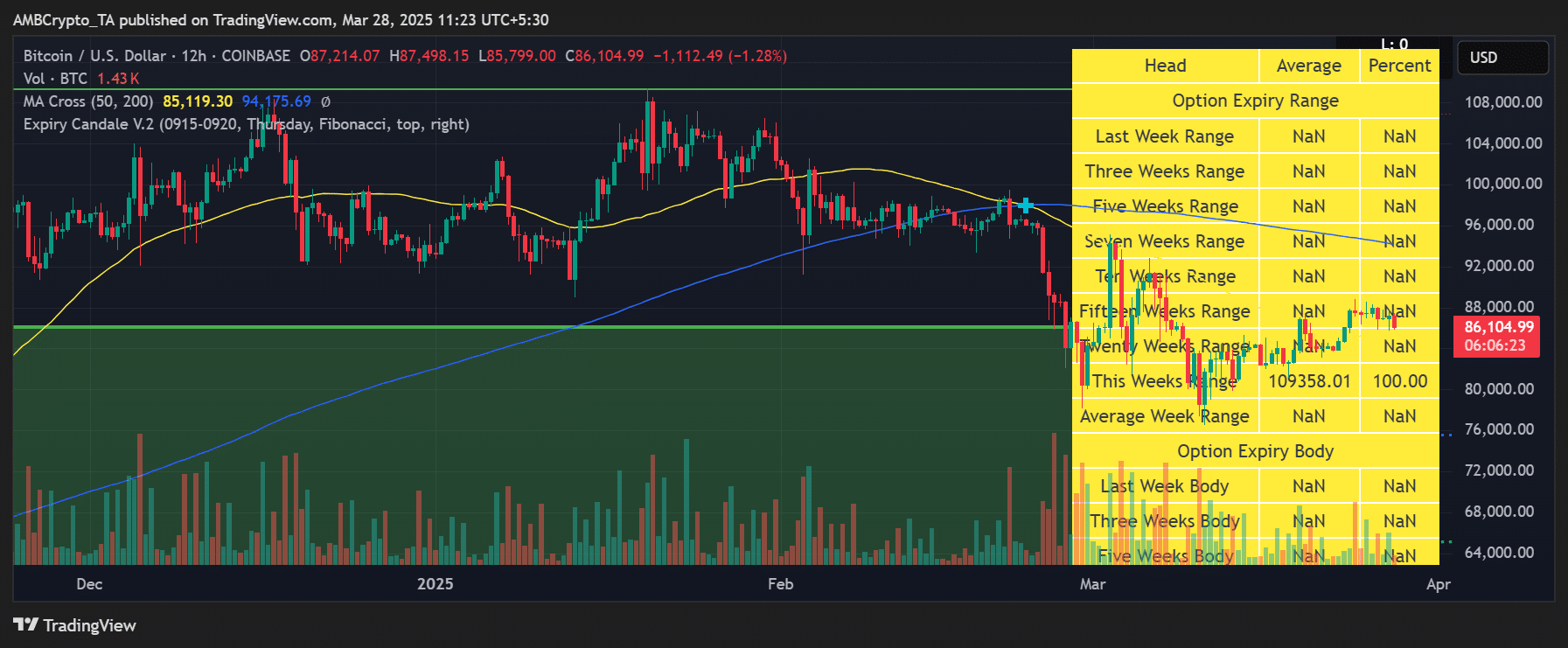

On the 12-hour BTC/USD chart, Bitcoin traded round $86,100, struggling to take care of upward momentum.

The 50-day MA at $85,119 acted as near-term help, whereas the 200-day MA at $94,175 loomed overhead as a key resistance.

Including to the uncertainty is the Expiry Candle indicator, which marks the present weekly expiry vary at $109,358, effectively above the present worth.

Traditionally, possibility expiry occasions can introduce volatility spikes however usually fail to push BTC past key psychological ranges except quantity follows by.

Low quantity and excessive threat: Can Bitcoin bulls maintain the push?

Quantity metrics recommend weakening participation, as mirrored within the comparatively muted buying and selling exercise regardless of elevated OI.

This divergence signifies that whereas positions are stacked, precise conviction stays low. Even minor worth shifts can spark liquidations and exaggerated strikes in such an setting.

In the meantime, on-chain information reveals some help close to the $85K area. If Bitcoin manages to carry this degree by expiry, it may function a launchpad for a $90K retest. Nonetheless, a break beneath may invite short-term promoting, particularly with closely skewed leverage.

Conclusion

As Bitcoin approaches the upcoming $16.5B choices expiry, all eyes are on whether or not bulls can reclaim $90K or if expiry-induced volatility will drive a brief pullback.

With heavy OI, combined indicators, and skinny quantity, the following 48 hours may show decisive for BTC’s development in Q2 2025.