- Bitcoin ETFs face $671.9M outflow, ending a 15-day streak as crypto costs plummet.

- Constancy, Grayscale lead ETF sell-off as $1B is liquidated throughout the crypto market in 24 hours.

Bitcoin’s [BTC]exchange-traded funds (ETFs) in the US skilled a record-breaking single-day internet outflow of $671.9 million on December 19.

This marks the biggest outflow since their launch and ended a 15-day streak of inflows for BTC ETFs and an 18-day streak for Ethereum [ETH] ETFs.

Knowledge from Farside Traders exhibits that Constancy’s FBTC led the outflows, shedding $208.5 million. Grayscale’s GBTC and ARK Make investments’s ARKB adopted with outflows of $208.6 million and $108.4 million, respectively.

In distinction, BlackRock’s IBIT ETF remained unchanged, with no reported internet outflows or inflows.

Market sell-off accompanies crypto value drops

The report outflows coincided with sharp declines in Bitcoin and Ethereum costs. Bitcoin dropped 9.2% within the final 24 hours, settling round $93,145.17, whereas Ethereum skilled a steeper 15.6% decline. Over $1 billion was liquidated throughout the crypto market on this interval.

Sosovalue knowledge revealed that the overall internet belongings of Bitcoin ETFs dropped to $109.7 billion as of the nineteenth of December, down from $121.7 billion simply two days earlier. This sharp lower erased a lot of the good points seen earlier in December.

The sell-off strengthened Bitcoin’s dominance within the crypto market, which stood at 57.4%, sustaining its place because the main asset regardless of the latest turbulence.

Federal Reserve coverage and broader financial considerations

The sharp downturn in crypto markets has additionally been linked to broader macroeconomic considerations. Traders anticipated a 0.25% rate of interest minimize from the U.S. Federal Reserve, however feedback from Fed Chair Jerome Powell instructed a extra cautious outlook.

Powell indicated that solely two fee cuts could happen in 2025, signaling a slower tempo of financial easing than anticipated.

The hawkish sentiment from the Federal Reserve additionally affected conventional markets, with the S&P 500 seeing a decline. Analysts consider this uncertainty could have additional pressured the crypto market, as threat sentiment shifted away from development belongings.

Elevated “purchase the dip” sentiment amidst market uncertainty

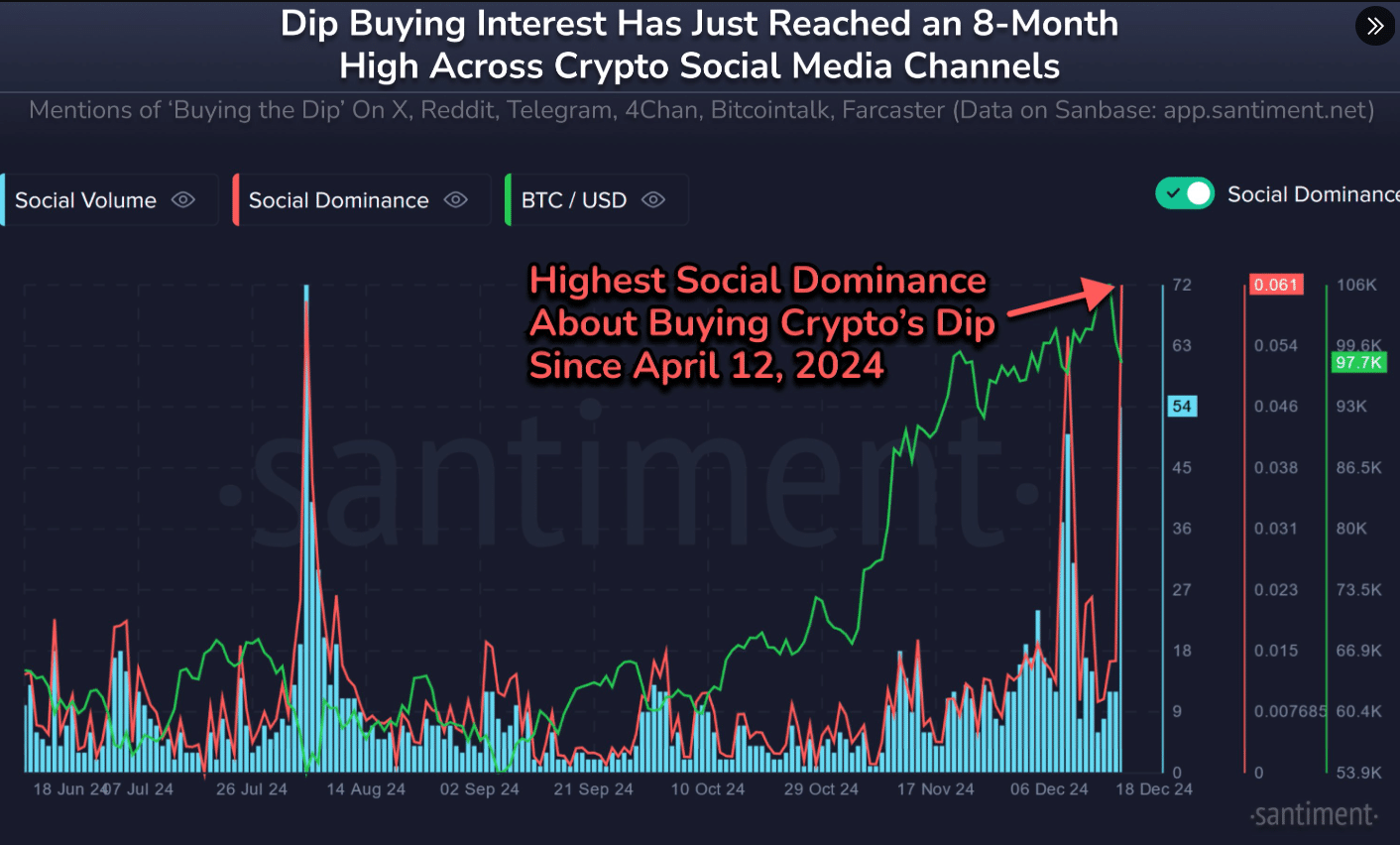

Regardless of the market downturn, a surge in “purchase the dip” discussions was noticed throughout social media platforms. Data from Santiment confirmed that mentions of “shopping for the dip” reached their highest degree in over eight months.

The final time this sentiment peaked was in April, when Bitcoin’s value fell from $70,000 to $67,000, earlier than persevering with its decline.

Learn Bitcoin’s [BTC] Price Prediction 2024-25

Whereas some merchants stay cautious, the renewed discussions counsel {that a} portion of traders stay optimistic about potential restoration alternatives within the crypto market.