Newest information on ETFs

Go to our ETF Hub to seek out out extra and to discover our in-depth knowledge and comparability instruments

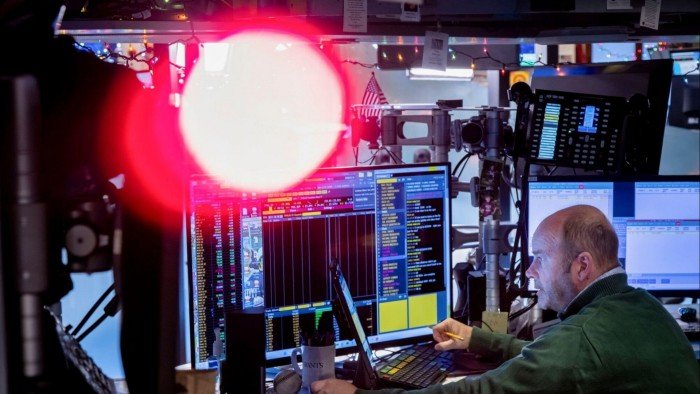

All roads led to Wall Avenue in November because the US fairness market dominated a document month for the worldwide trade traded fund business.

Web flows into ETFs globally hit $205bn in final month, in keeping with BlackRock, outstripping the earlier document of $199bn set in July.

But US fairness ETFs accounted for a document $149bn of this — effectively forward of the earlier peak of $98.5bn in December 2023 — as just about each different nook of the funding universe was floor into the mud by the onward march of Wall Avenue.

Fastened earnings ETFs pulled in an anaemic $35.1bn, comfortably under October’s $49.9bn, whereas commodity ETFs suffered internet outflows of $3.6bn as buyers pulled cash out for the primary time since April.

Non-US fairness markets have been equally out of favour, with $5.1bn stripped from European fairness ETFs, $2.9bn from Japanese inventory funds and $3.8bn from their rising market friends — the primary time all three markets have recorded concurrent month-to-month outflows since Could 2019, in keeping with BlackRock.

The surge into the US inventory market was pushed by Donald Trump’s clear victory within the US presidential election, which constructed on already robust market momentum.

November was a “historic month”, stated Karim Chedid, head of funding technique for BlackRock’s iShares within the Emea area, with “the massive theme rerisking from buyers in a month the place we’ve had readability across the end result of the US election”.

Chedid stated this constructed on robust sentiment emanating from the just lately concluded earnings season, which delivered 7 per cent year-on-year earnings, comfortably forward of subdued expectations of three per cent, alongside a widening hole in financial knowledge between the US and a weaker Europe.

Matthew Bartolini, head of SPDR Americas analysis at State Avenue World Advisors, stated this transatlantic gulf was wider nonetheless in fairness markets, with the S&P 500’s post-election bounce of 6 per cent in November taking its year-to-date good points to 26 per cent, at the same time as a post-election wobble in European equities amid fears of upper tariffs trimmed year-to-date returns to five per cent.

This 21 share level return differential is the very best for 15 years, Bartolini stated. This “illustrates how there’s extra to the US’s reign than the current post-election rally narratives,” he added.

“For starters, the US has had stronger elementary momentum in 2024. Ahead-looking sentiment is powerful too. The US is projected to have stronger earnings progress in every of the following 4 quarters — 6 share factors, on common — than the remainder of the world.”

Amid this backdrop, some European buyers seem like giving up on their home bourses: internet purchases of Europe-listed US fairness ETFs hit a document $23.2bn in November, BlackRock stated.

“Buyers abroad jumped on the alternative to extend publicity to the US inventory market,” stated Syl Flood, senior product supervisor at Morningstar, with the Eire-domiciled iShares Core S&P 500 ETF USD (CSSPX) pulling in $4bn, $1bn greater than its earlier month-to-month document, set in January.

Bartolini, whose evaluation solely covers US-listed ETFs, stated that the rolling three-month circulation differential between US and non-US fairness ETFs hit an “eye-popping” $188bn, one other document.

Whereas ETFs monitoring the blue-chip S&P 500 dominated flows, as ordinary, Chedid famous that extra cyclical areas, comparable to small and mid-cap shares and financials, additionally noticed robust shopping for, mirroring the sample within the wake of Trump’s earlier election victory in November 2016.

His undisputed re-election “has eliminated the uncertainty premium for markets,” Chedid stated, whereas additionally doubtlessly ushering in lighter regulation, notably for monetary shares.

“Buyers positioned unusually massive sums with financials-focused ETFs,” stated Flood, with month-to-month flows topping $9.4bn, yet one more document.

“The Monetary Choose Sector SPDR ETF (XLF), the biggest financials sector fairness ETF at $51bn, noticed document flows of $4.1bn” though greater than $1bn of this was withdrawn within the first three days of December, he added.

“Buyers made an excellent bigger proportional guess on SPDR S&P Regional Banking ETF (KRE); it grew by a 3rd as a result of November’s flows of $1.4bn”.

Flood additionally famous that Eire, Europe largest ETF domicile, noticed document inflows of $31.5bn (taking belongings to $1.6tn), with everything of this cash being pumped into equities.

And though US-domiciled fastened earnings ETFs did see inflows, Bartolini calculated that fairness minus bond trailing three-month flows hit yet one more document.

Nearly the one different asset that did see an excellent month was cryptocurrency. Morningstar’s record of the highest 10 ETFs by flows in November was dominated by US fairness autos with the only real exception being the iShares Bitcoin Belief (IBIT), nestled in fifth with $5.8bn of internet new cash as Trump election ushered in a contemporary wave of enthusiasm for digital belongings.

The large query now’s whether or not Wall Avenue can keep its excessive ascendancy, or whether or not flows will develop into a little bit extra balanced.

“That’s a giant query that shoppers ask us,” stated Chedid. “In our view there are fundamentals that drive that desire for US equities. We see some selective alternatives coming via in different elements of the world, however we do want to emphasize the phrase ‘selective’,” he added, noting that “this yr has been first rate for UK equities”.

And whereas continental Europe “has been considerably weaker when it comes to flows”, amid “a structural decline in manufacturing exercise” a service sector restoration that has “fizzled out” and an unhelpful geopolitical backdrop, Chedid did notice that actively managed European fairness ETFs had seen internet shopping for, one thing he attributed to buyers looking for out such selective alternatives.