According to an analyst, Bitcoin sits in a liquidity set-up that has shown up before big rallies. Prices are not shooting higher yet. At press time Bitcoin trades around $104,500, down 0.5% over the past day.

Related Reading

Traders watched a decline of about 1.8% earlier that pushed the price near $103,400 and it briefly touched $102,850 during the move.

Stablecoin Signal Points Toward Accumulation

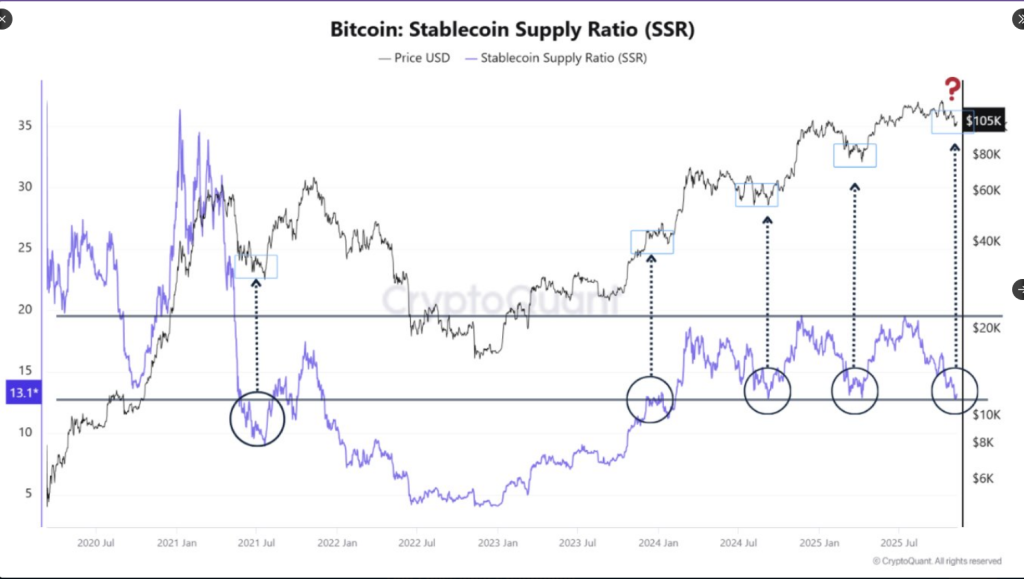

CryptoQuant analyst Moreno points to the Stablecoin Supply Ratio, or SSR, as the first clear indicator. The SSR compares Bitcoin’s market cap to the total market cap of stablecoins. It has dropped back into the 13 range.

Based on historical readings, that 13 area has lined up with market lows in mid-2021 and at several moments across 2024. Reports show that when SSR fell to similar levels, liquidity quietly built up and buying followed after a period of low volatility.

Liquidity Pattern Has Appeared Before Every Bitcoin Surge — And It’s Back

“We’re witnessing a liquidity configuration that has only appeared a handful of times since 2020, and each instance marked a pivotal moment for Bitcoin’s trajectory.” – By @MorenoDV_ pic.twitter.com/vWKcCkyn55

— CryptoQuant.com (@cryptoquant_com) November 11, 2025

Binance Reserve Trends Add A Second Layer

The second metric Moreno highlights comes from Binance. On that exchange, stablecoin balances are rising while Bitcoin reserves are shrinking. In plain terms: more cash-like tokens sit on the exchange and fewer coins are being held there.

That pattern has appeared only a handful of times since 2020, according to the data he referenced. Each time, the movement suggested capital waiting on the sidelines and holders moving coins off exchanges into longer-term storage.

Market Calm Can Hide Big Moves

The current trading backdrop is cautious. Many investors expected a lift after news that the US Congress approved short-term federal funding through January 30, yet crypto did not rally with other risk assets.

Some capital rotated back to stocks. At the same time, large holders took profits after recent highs, and momentum cooled. That mix shows how macro events can shift flows without immediately turning into crypto buying.

Risk Still Exists — Structure Could Break

Moreno warns this liquidity zone acts like a final structural support. If the metrics break down decisively, it could signal a deeper reset before any sustained recovery.

In that scenario, buying would likely be delayed and volatility would rise. This is not a guaranteed outcome, but it is a clear risk that traders watch closely.

Outlook: Limited Downside, Growing Upside

Based on reports and on-chain signals, Moreno believes the risk-to-reward favors buyers at these levels. He points to the built-up stablecoin supply and falling exchange BTC reserves as reasons for that view.

Related Reading

Historical patterns suggest the last three months of the year often bring gains for Bitcoin, but past behavior does not promise future returns.

For now, the indicators show capital parked in stablecoins and fewer coins available on major exchanges. That creates a setup where fresh buying could push the market higher quickly if sentiment turns.

Yet the opposite is possible: a break below these levels would reshape the cycle and force many participants to rethink positions. Markets will decide which path comes next.

Featured image from Gemini, chart from TradingView